uick Summary

- XRP hits $2.13 amid renewed bullish momentum and regulatory clarity

- Whale accumulation and Ripple’s institutional push support price surge

- Analysts eye $2.38 and $3.00 as key breakout targets

- Short-term pullbacks possible, but macro sentiment remains optimistic

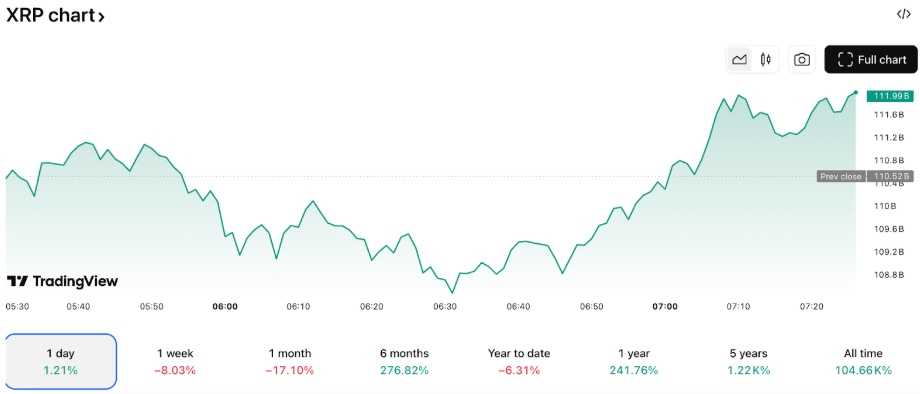

Ripple’s XRP is back in the spotlight after rallying to $2.13, reigniting hopes among long-time holders and attracting fresh attention from retail and institutional investors alike. This marks the highest price level XRP has seen in over a year, and analysts are now debating whether the rally has more room to run—or if a correction is imminent.

Regulatory Clarity Fuels Optimism

Much of XRP’s renewed strength is attributed to Ripple’s ongoing legal wins against the U.S. Securities and Exchange Commission (SEC). The partial court victory in 2024, which clarified XRP is not a security in secondary market sales, gave Ripple the green light to resume expansion without fear of further legal entanglements.

The recent approval of Ripple’s stablecoin, RLUSD, by the New York Department of Financial Services further reinforced investor confidence, positioning Ripple to become a dominant player in cross-border payments and enterprise blockchain solutions.

Whale Activity and Technical Momentum

According to on-chain data from WhaleAlert, large XRP wallets have increased their activity over the past week, with several transactions exceeding 100 million tokens. Analysts interpret this as a sign of accumulation rather than distribution, suggesting big players expect more upside.

From a technical perspective, XRP’s clean break past $2.00 was significant. It now sits just below the $2.38 resistance zone, a level that previously rejected advances in 2021 and 2023. A confirmed breakout could open the door to the psychological $3.00 mark—a milestone not seen since the 2018 bull market.

Analyst Outlooks: Short-Term Hurdles, Long-Term Hope

Crypto analyst EGRAG recently projected a near-term target of $2.92, followed by an extended rally potentially reaching $6.40, assuming market conditions remain favorable (Finbold).

Still, others warn of a possible cooling-off phase. “We’re likely to see some consolidation between $2.10 and $2.30,” noted trader Alex Krüger. “But if macro conditions hold, XRP has the fundamentals to outperform.”

What Should Retail Investors Watch?

Key support zones are forming at $2.13 and $1.95, while $2.38 remains the immediate resistance to beat. As always, volume and sentiment will be critical.

XRP is also seeing increased mentions across crypto social media channels, suggesting rising retail engagement. Sentiment remains positive, though traders are keeping an eye on Bitcoin’s behavior as a macro barometer.

Final Take

XRP at $2.13 isn’t just a price point—it’s a psychological signal that the token is back in play. With legal headwinds easing and institutional activity rising, XRP could be poised for another leg up. But traders should stay alert: high-profile rallies can bring just as much volatility as upside.

As always in crypto, it’s not just about where the price is—it’s about where the momentum is headed.

Note: This article reflects market conditions and forecasts as of April 10, 2025. Crypto markets are inherently volatile. Readers are encouraged to do their own research before making investment decisions.

Andrej is an experienced content and copywriter who’s been creating impactful, engaging content since 2022. Though he’s worked across various of industries, he specializes in Crypto, Web3, and SaaS. From in-depth blog posts to high-converting web copy, he combines strategic thinking with a natural flair for storytelling to deliver content that not only informs but also resonates with readers