From Rollups to Governance, Here’s Everything You Need to Know About the Arbitrum Ecosystem

Introduction

Launched in February 2020, Arbitrum was the first Ethereum Layer-2 (L2) rollup network to enter public testing. It played a pivotal role in igniting Ethereum’s L2 revolution—aimed at lowering gas fees and improving scalability without compromising on decentralization. Today, Arbitrum stands as a leading L2 solution, hosting over 780 decentralized applications (dApps) and securing billions in total value locked (TVL).

This beginner-friendly guide breaks down everything you need to know about Arbitrum—from how it works, to its tokenomics, governance, and standout features.

Key Takeaways

- Arbitrum is a Layer-2 scaling solution that enhances Ethereum’s performance by reducing fees and improving speed.

- Its ecosystem includes Arbitrum One, Arbitrum Nova, Arbitrum AnyTrust, Orbit, and Stylus.

- ARB is Arbitrum’s governance token, giving holders voting power over protocol upgrades and treasury management.

- Arbitrum supports multi-language smart contract development, making it more developer-friendly than most L2s.

- Its modular suite allows developers to build both public and permissioned chains for different use cases.

What is Arbitrum?

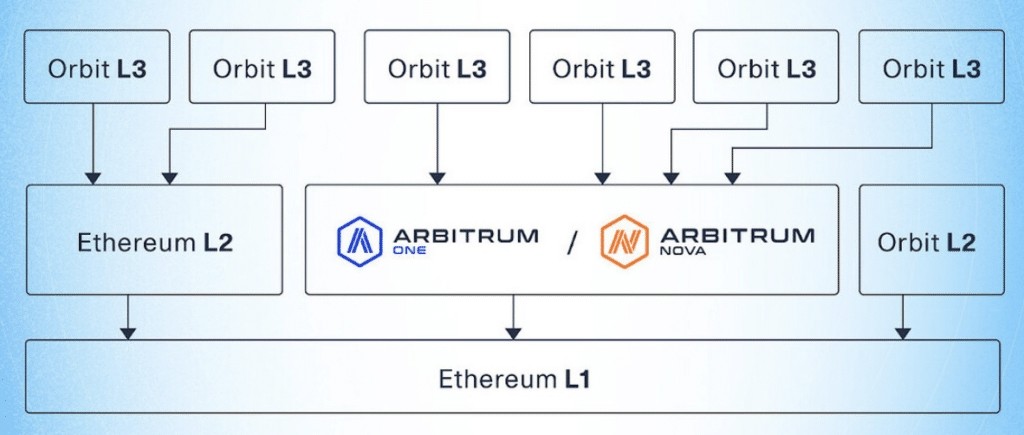

Arbitrum is a suite of Layer-2 scaling solutions built to enhance the Ethereum network by making it faster, cheaper, and more efficient. Its flagship product, Arbitrum One, is an optimistic rollup—a secondary blockchain that processes transactions off-chain while still relying on Ethereum’s Layer-1 for security and settlement.

Arbitrum allows developers to build decentralized applications (dApps) that are fully compatible with Ethereum but benefit from significantly lower gas fees and faster transaction speeds. Over time, the Arbitrum ecosystem has grown to include additional products like Arbitrum Nova, Orbit, and Stylus, offering specialized solutions for gaming, social platforms, and advanced smart contract development.

Rather than being just a single blockchain, Arbitrum has become an L2 infrastructure hub for building public and permissioned blockchains with diverse use cases.

Terms You Should Know

Before diving deeper, here are some essential terms:

- L1: A base-layer blockchain like Ethereum.

- L2: A secondary chain that enhances L1 by processing transactions off-chain and posting them back to L1.

- Rollups: Bundled transactions that are submitted to L1 for cost-efficient execution.

- Optimistic Rollups: Assume transactions are valid unless challenged.

- Sequencer: A node that orders and batches transactions before submitting to L1.

Arbitrum’s Ecosystem

- Arbitrum One: The flagship optimistic rollup, permissionless and public.

- Arbitrum Nitro: The core protocol stack powering the ecosystem.

- Arbitrum Nova: Built on AnyTrust for gaming and social apps; uses a Data Availability Committee (DAC) for faster, cheaper performance.

- Orbit Chains: Custom L2/L3 chains built with the Arbitrum Orbit SDK.

- Stylus: Enables developers to write smart contracts in Rust, C, and C++, not just Solidity.

History and Development

Arbitrum is developed by Offchain Labs, a Princeton-founded team led by Ed Felten, Steven Goldfeder, and Harry Kalodner. The team launched its testnet in 2020 and mainnet in 2021, followed by key innovations like Nitro (2022), Nova, and the ARB token (2023). In 2024, the ArbitrumDAO approved native staking, expected to launch in 2025.

About the Founders of Arbitrum

Arbitrum was created by a trio of researchers from Princeton University who went on to co-found Offchain Labs, the core development company behind the protocol:

- Ed Felten – A renowned computer science professor at Princeton University and former White House Deputy CTO. He currently serves as Chief Scientist at Offchain Labs.

- Steven Goldfeder – Holds a PhD in computer science from Princeton and serves as CEO of Offchain Labs. His expertise lies in cryptography and secure distributed systems.

- Harry Kalodner – CTO of Offchain Labs and a fellow Princeton PhD, with research focused on blockchain systems and economic modeling.

Their combined academic and technical backgrounds have made Arbitrum one of the most technically sound and widely adopted L2 solutions in the blockchain industry.

What Problems Does Arbitrum Solve?

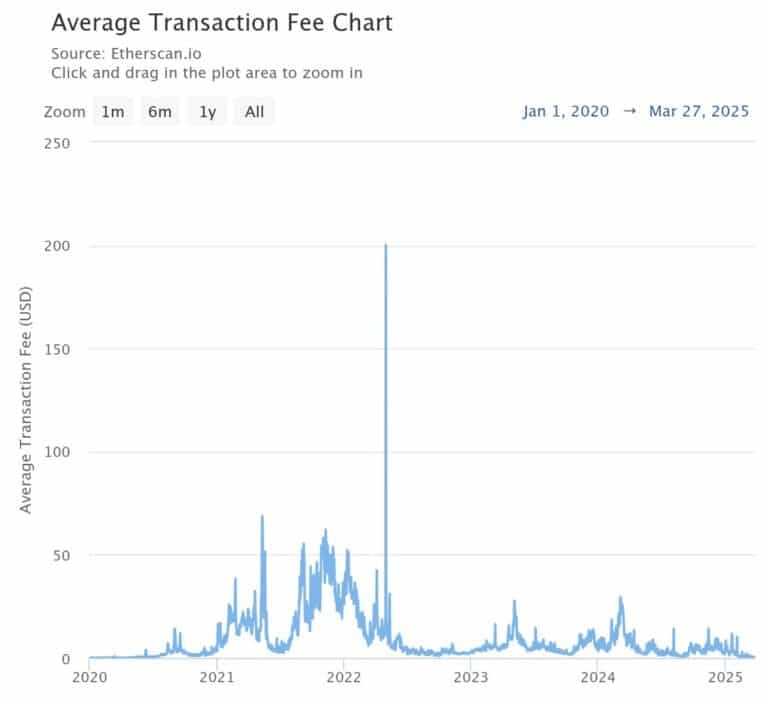

Arbitrum addresses Ethereum’s scalability limitations—specifically, its low throughput and high gas fees. During periods of congestion, Ethereum users can face transaction costs upwards of $100. Arbitrum reduces this by:

- Batching transactions

- Settling on Ethereum for security

- Distributing L1 gas costs across multiple users

This results in much cheaper and faster transactions while maintaining Ethereum-grade security.

Arbitrum Tokenomics

- Token Symbol: ARB

- Function: Governance only (not for gas fees)

- Launched: March 2023

- Initial Supply: 10 billion

- Inflation: Max 2% annual increase

Allocation Breakdown

| Allocation | % of Supply | Tokens |

|---|---|---|

| Arbitrum DAO Treasury | 35.28% | 3.528B |

| Team, Contributors, Advisors | 26.94% | 2.694B |

| Investors | 17.53% | 1.753B |

| Community Airdrop | 11.62% | 1.162B |

| Arbitrum Foundation | 7.5% | 750M |

| DAOs on Arbitrum | 1.13% | 113M |

Governance and Staking

Arbitrum’s ecosystem is governed by:

- ArbitrumDAO: A decentralized organization where ARB holders can vote and propose upgrades.

- Arbitrum Foundation: A non-profit supporting ecosystem growth and funding.

- Security Council: A 12-member team with emergency and non-emergency powers, overseen by the DAO.

In 2024, ARB staking was approved and is expected to go live in 2025, with liquid staking options enabled by Tally Protocol.

How Does Arbitrum Work?

Arbitrum operates as an optimistic rollup, a Layer-2 solution that scales Ethereum by executing transactions off-chain and then posting their data to the Ethereum mainnet (Layer-1). Here’s how it works:

- Transaction Execution: Users conduct transactions on Arbitrum One, the main L2 chain. These transactions are processed and bundled by a component called the sequencer.

- Batch Submission: The sequencer batches multiple transactions together and posts the data to Ethereum. This batching reduces congestion and lowers gas fees.

- Assumed Validity: Because Arbitrum is an optimistic rollup, it assumes all submitted transactions are valid unless challenged. Anyone can contest a transaction during the seven-day challenge period using the posted data.

- Security from Ethereum: All L2 transaction data is stored on Ethereum, allowing for full transparency and enabling independent verification of L2 activity.

This structure means Arbitrum users benefit from the scalability and speed of L2 while inheriting Ethereum’s security guarantees.

Why It Matters

- It dramatically lowers transaction costs by splitting Ethereum gas fees across many L2 transactions.

- It maintains trustlessness and decentralization through the challenge mechanism and Ethereum-based finality.

- It provides faster user experiences (low latency and near-instant confirmations) while posting immutable data to Ethereum.

Technical Performance

| Metric | Ethereum | Arbitrum One |

|---|---|---|

| Max Throughput | 62 TPS | 1,105 TPS |

| Block Time | 12 seconds | 0.25 seconds |

| Avg. Gas Fees | $0.44 | $0.0058 |

Arbitrum significantly outperforms Ethereum in terms of speed and cost-efficiency.

ARB’s Audit Report

Arbitrum has undergone independent security reviews from leading blockchain auditing firms, reflecting strong technical confidence in the project.

- CertiK, a top-tier blockchain security firm, scored Arbitrum 94.3 out of 100 in its real-time Skynet audit system. This placed Arbitrum in the top 5% of all rated projects.

The score was based on six key categories:- Code security

- Governance strength

- Market stability

- Community trust

- Core fundamentals

- Operational resilience

- Cyberscope, another smart contract auditing firm, rated Arbitrum 85 out of 100, classifying it as a “very low-risk” crypto project.

These high scores confirm Arbitrum’s robust technical design, operational stability, and well-governed development practices.

Community & On-Chain Insights

- 1.1M+ followers on X (Twitter)

- Strong presence on Discord

- Whale concentration: 27.8%

- Long-term holders (>1 year): 46%

ARB is widely held by retail users, with only 4.9% of tokens actively traded.

Expert Opinions

Industry analysts often describe Arbitrum as a “reseller of Ethereum block space”, akin to zipping large files to save bandwidth. Its deep alignment with Ethereum and customizable solutions make it an essential player in Ethereum’s broader scaling strategy.

Still, analysts warn of competition from other L2s and the downside of high token unlock schedules and limited utility for ARB holders.

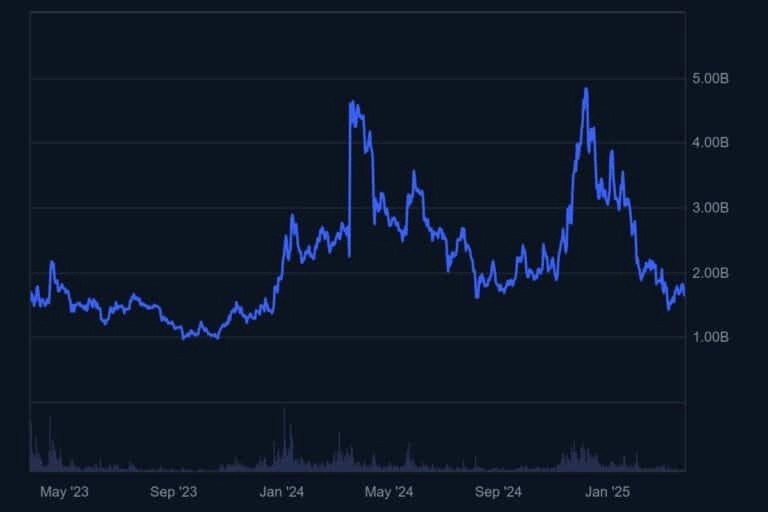

Is ARB a Buy?

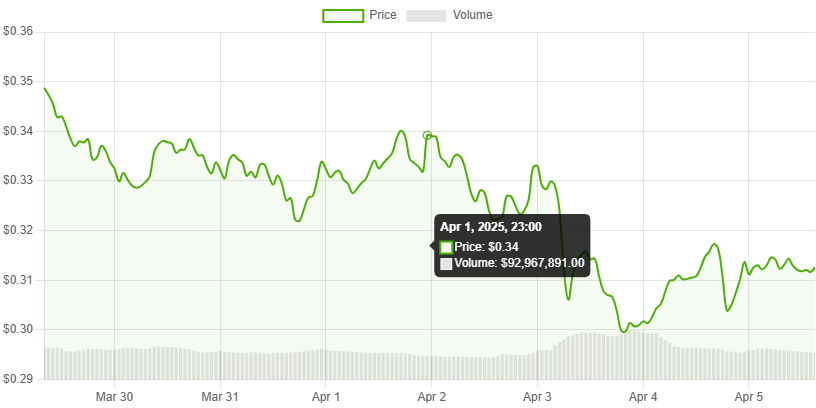

While Arbitrum is one of the strongest L2 platforms technically and fundamentally, the ARB token has underperformed, down more than 70% since launch. Challenges include:

- Regular token unlocks putting pressure on price.

- Limited utility of ARB beyond governance.

- High insider allocation, reducing community exposure.

As of April 4, 2025, ARB trades at $0.31, with a market cap of $1.45B.

Where to Buy and Store ARB

Top Exchanges:

- Binance

- OKX

- eToro

- ByBit

- Uniswap (on-chain, requires ETH gas)

Recommended Wallets:

- MetaMask – Popular browser/mobile wallet

- Best Wallet – Beginner-friendly, with DEX aggregator

- Ledger Nano X – Cold storage with top-tier security

- ELLIPAL Titan 2.0 – Air-gapped QR-based hardware wallet

Conclusion

Arbitrum is more than just an Ethereum scaling solution—it’s a versatile blockchain platform with an expanding suite of developer tools and governance frameworks. With high throughput, low fees, strong Ethereum compatibility, and growing community support, Arbitrum is well-positioned to remain a dominant force in the L2 ecosystem.

That said, the ARB token’s performance may not yet reflect Arbitrum’s full potential. As utility improves and native staking goes live, ARB could evolve into a more robust asset for both governance and value capture.

Since 2023, Yoshi Ae has combined storytelling and community insight as a PR writer, creating content that resonates across platforms like X and Discord. From press releases to narrative campaigns, Yoshi bridges brand messaging with real-time community engagement.