Key Takeaways

- President Trump imposes sweeping global tariffs, escalating trade tensions and creating uncertainty across financial markets.

- Bitcoin’s price volatility intensifies, reacting to macroeconomic instability triggered by new U.S. trade policies.

- Crypto analysts predict long-term upside for Bitcoin, citing its potential as a hedge against fiat currency devaluation.

- Investors increasingly turn to alternative assets like Bitcoin and tokenized real-world assets, fearing inflation and economic slowdown.

- The U.S. dollar faces weakening pressure, fueling debate over Bitcoin’s viability as a long-term store of value.

Trump’s New Tariffs Spark Global Market Turmoil and Crypto Conversations

In a bold move shaking global financial markets, President Donald Trump has announced sweeping tariffs aimed at correcting international trade imbalances. The policy includes a 10% baseline tariff on all imports, with significant increases targeting key trading partners: 34% for China, 20% for the European Union, and similar hikes for Japan and Vietnam. A 25% tariff on automotive imports further intensified the situation.

The announcement triggered chaos across equities. The S&P 500 lost over $2 trillion in market capitalization within 15 minutes. The Nasdaq plummeted 5.1%, and the Dow Jones neared correction territory, dropping nearly 10% from its December peak. European indexes, including Germany’s DAX, also tumbled, with brands like Adidas and Puma suffering sharp double-digit losses.

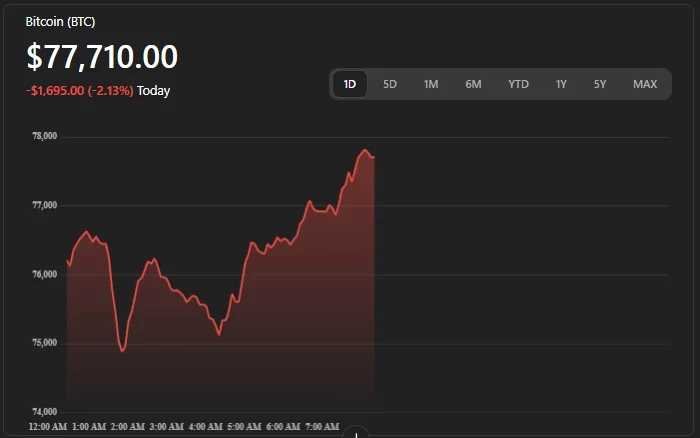

Bitcoin Price Drops—But Long-Term Crypto Sentiment Remains Bullish

The crypto market, long viewed as a hedge against economic instability, responded with mixed signals. Bitcoin (BTC) dropped 8.5% following the tariff announcement, underperforming even traditional equities on that day. Yet despite the short-term decline, crypto insiders remain optimistic about Bitcoin’s long-term role as digital gold.

Bitcoin hovers near the $90,000 mark, a psychological threshold closely watched by traders. Market watchers believe that if macroeconomic instability continues, BTC’s decentralized supply and inflation-resistant structure could boost its appeal as a safe-haven asset.

Bitcoin Price Trend vs Dollar Weakness

Source: CoinGecko

Crypto Experts: Weaker Dollar Could Supercharge Bitcoin Adoption

According to Jeff Park, Head of Alpha Strategies at Bitwise Asset Management, Trump’s tariffs are designed to weaken the U.S. dollar on the global stage. By devaluing the dollar, U.S. exports become more competitive—mirroring strategies from the Plaza Accord of 1985.

Park suggests that as inflation rises in response, investors may increasingly allocate capital into Bitcoin and other cryptocurrencies to hedge against fiat erosion. Bitcoin’s fixed 21 million supply gives it an advantage in times of monetary uncertainty, making it a hedge not only against inflation but also geopolitical volatility.

Inflation Fears Push Retail and Institutional Investors Toward Crypto

As fear of inflation grows, investors are pivoting toward alternative assets, including crypto and tokenized real-world assets (RWAs) like real estate, collectibles, and luxury goods. Blockchain analytics firm IntoTheBlock reported a notable uptick in RWA inflows as traditional markets stagger under the weight of uncertainty.

This trend reinforces the idea that crypto is maturing into a diversified asset class, suitable not just for tech-savvy traders but also conservative investors seeking long-term value preservation.

Dollar Devaluation Sparks Talk of a Bitcoin Standard

Trump’s tariffs are rekindling questions about the longevity of the U.S. dollar as the world’s reserve currency. Analysts argue that if protectionist economic policies persist, Bitcoin could evolve from a speculative asset into a full-fledged alternative monetary system.

With the dollar under pressure, Bitcoin’s borderless, decentralized architecture offers a compelling alternative for global citizens and institutions seeking stability in an increasingly fragmented financial world. As emerging economies look for alternatives to dollar dependency, Bitcoin adoption could accelerate worldwide.

Conclusion: Bitcoin’s Moment to Shine Amid Trade Turmoil?

President Trump’s aggressive tariff playbook is rattling traditional markets and reshaping the global economic narrative. While short-term volatility persists, the macroeconomic backdrop is strengthening Bitcoin’s case as a long-term store of value.

For retail investors, this moment underscores the importance of diversification, exposure to crypto, and rethinking traditional fiat assumptions. Whether Bitcoin will replace the U.S. dollar is up for debate—but its role in the future of global finance seems more certain than ever.

As central banks and governments struggle to contain inflation and currency devaluation, Bitcoin remains the one asset with a transparent monetary policy and built-in scarcity. That may be exactly what the post-tariff era needs.

Disclaimer: This article is for informational purposes only. It is not financial advice. Always do your own research (DYOR) before investing in cryptocurrencies.

Andrej is an experienced content and copywriter who’s been creating impactful, engaging content since 2022. Though he’s worked across various of industries, he specializes in Crypto, Web3, and SaaS. From in-depth blog posts to high-converting web copy, he combines strategic thinking with a natural flair for storytelling to deliver content that not only informs but also resonates with readers