From Visionary to Volatile: Why Tesla’s Brand Is Breaking Down

Tesla’s remarkable rise has long been powered by bold vision, rapid innovation, and the magnetic presence of Elon Musk. But in 2025, that formula appears to be breaking down. The electric vehicle leader is now confronting a deepening identity crisis—and its investors are no longer staying quiet.

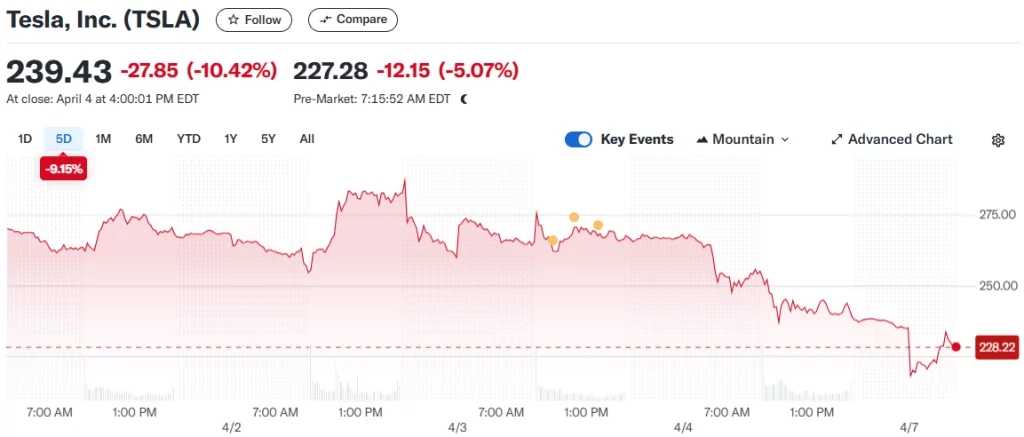

The company’s stock has dropped 37% year-to-date, sparking urgent calls for a leadership change as critics point to missed performance targets and growing reputational risks.

Shareholder Frustration Hits Boiling Point

Long-time Tesla bull and shareholder Ross Gerber is leading a wave of discontent. His firm, which owns over 262,000 TSLA shares, has publicly urged the board to appoint a new CEO.

“Tesla needs someone who reminds the world what the company actually does,” Gerber said in a recent interview. “Right now, it’s noise, not mission.”

Gerber’s comments reflect a growing consensus among investors who believe Musk’s personal distractions and erratic public behavior are harming Tesla’s image at a time when it can least afford to lose momentum.

The Brand Has Lost Its Signal

Tesla’s brand was once synonymous with future-forward innovation. Today, it’s increasingly viewed as a divisive symbol—less about clean tech and more about controversy. For many customers, the shift in perception is no longer ignorable.

Analyst Dan Ives of Wedbush, historically one of Tesla’s most supportive voices, now sees this shift as a serious long-term threat.

“This isn’t just about Q1 numbers. This is about what Tesla represents—and that clarity has been lost,” he wrote in a sharply worded note.

Q1 Performance Misses the Mark

Tesla reported deliveries of 337,000 vehicles in Q1, down 13% from the same period last year and 40,000 units below Wall Street’s consensus. That’s a significant miss for a company that once set the pace for EV production globally.

The delivery shortfall has rattled confidence, especially as Tesla faces heightened competition from emerging EV startups and legacy automakers aggressively entering the space.

Ives slashed his price target from $550 to $315, citing what he calls a “self-inflicted brand spiral.” Despite maintaining a Buy rating, his language signals a shift in tone: from admiration to caution.

Can a Leadership Change Revive Tesla?

Gerber believes the answer lies in resetting the company’s identity. He argues that a new CEO—focused, communicative, and grounded in the mission—could re-center the brand and bring focus back to innovation and execution.

“It doesn’t even matter who it is. It just needs to be someone who can lead without distracting from the core of Tesla’s value.”

Tesla’s board has not commented publicly on any plans to shift leadership, though internal sources suggest discussions are happening behind closed doors.

Looking Ahead: A Turning Point or a Warning Sign?

Tesla’s current valuation sits below $250 per share—down nearly 70% from its all-time high. Gerber warns that, without change, the stock could fall another 50%, putting it in the $140 range.

The mood on Wall Street has shifted from optimistic to uneasy. Once a darling of innovation and disruption, Tesla now finds itself weighed down by messaging inconsistency, delivery misses, and leadership fatigue.

If the company fails to realign its strategy—and its public persona—Tesla risks losing not just market share, but also the public trust that once made it untouchable.

Disclaimer: This article is for informational purposes only. It is not financial advice. Always do your own research (DYOR) before investing in cryptocurrencies.

Since 2023, Yoshi Ae has combined storytelling and community insight as a PR writer, creating content that resonates across platforms like X and Discord. From press releases to narrative campaigns, Yoshi bridges brand messaging with real-time community engagement.