Key Takeaways

- Ripple to acquire prime brokerage Hidden Road for $1.25 billion, marking one of crypto’s biggest Wall Street moves yet (Reuters).

- Strategic push to expand into traditional finance, giving Ripple institutional clout and access to $3 trillion+ annual trade volume

- Ripple’s RLUSD stablecoin set to be integrated into Hidden Road’s platform, boosting utility and bridging TradFi with DeFi

- Deal signals maturing U.S. crypto regulation, paving the way for institutional growth in the digital asset space

- XRP Ledger to benefit from deeper institutional usage, reinforcing the network’s importance in global finance

Ripple’s $1.25B Gamble Could Reshape the Future of Crypto and Finance

In what could be a watershed moment for both the crypto and traditional financial sectors, Ripple has announced its intent to acquire global prime brokerage firm Hidden Road Partners for a whopping $1.25 billion. According to a Reuters report, this move would mark one of the largest acquisitions in the industry to date—and a statement of intent from Ripple to go beyond payments and become a core player in institutional finance.

This acquisition gives Ripple a direct line into the $3 trillion in annual transaction volume that Hidden Road facilitates, across FX, equities, crypto, and credit markets. More importantly, it reflects a seismic shift—one where blockchain-native firms are now absorbing the roles once dominated by Wall Street.

What Is Hidden Road? Ripple’s Institutional Power Move Explained

Hidden Road may not be a household name, but in the world of institutional trading, it’s a powerhouse. The firm provides prime brokerage services to more than 300 global clients, including hedge funds, asset managers, and proprietary trading shops. It offers clearing, leveraged trade execution, securities lending, and more—basically, the behind-the-scenes mechanics that keep high-frequency markets moving.

By acquiring Hidden Road, Ripple isn’t just adding capabilities. It’s becoming the first crypto-native company to own and operate a multi-asset global prime broker.

This opens the door for RippleNet and other blockchain infrastructure to be integrated directly into traditional finance workflows, offering faster settlement, more transparency, and lower costs than legacy systems. It also creates a compelling use case for RLUSD, Ripple’s new USD-backed stablecoin, which Hidden Road plans to use as collateral across its entire trading stack.

Ripple and XRP: Institutional Integration in Real Time

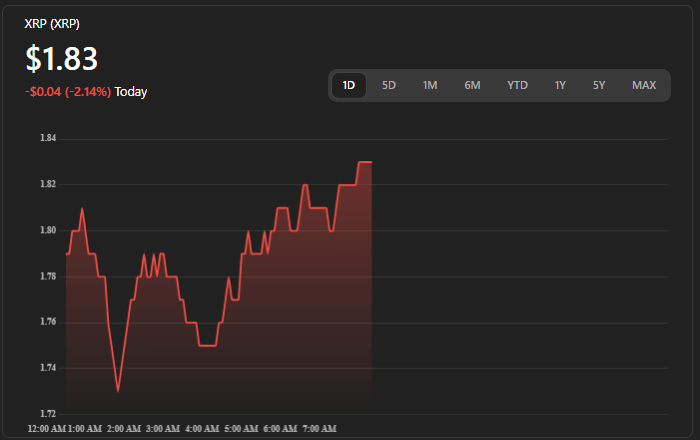

Source: CoinGecko

In addition to stablecoin adoption, the deal will also see Hidden Road migrate significant post-trade functions to the XRP Ledger (XRPL). That’s a big win for XRPL, the blockchain Ripple developed for financial-grade, enterprise-focused applications. It means more utility, more throughput, and real-world usage—not just speculative trading.

As Ripple CEO Brad Garlinghouse put it in a press statement:

“We’re building for a world where crypto and fiat systems coexist. Hidden Road brings us closer to that by giving Ripple institutional scale.”

Why Ripple’s Acquisition Matters for TradFi and Crypto

Let’s be clear—this isn’t Ripple experimenting with a side project. It’s an offensive play into the very heart of global financial infrastructure.

Institutional prime brokers like Hidden Road are the gatekeepers of leverage, collateral management, and risk mitigation. By controlling one of the most agile and tech-forward brokers in the business, Ripple can now offer:

- Instant cross-asset margining

- Stablecoin-settled trades across FX, equities, and crypto

- Direct onboarding for TradFi clients into digital assets

This changes the narrative. Ripple is no longer just the company that’s been duking it out with the SEC or running cross-border payment pilots. It’s now the owner of a regulated bridge between old money and programmable finance.

Related: Public Companies Are Stacking Bitcoin—So Why Is Crypto Crashing?

This move also signals a resurgence in U.S. crypto activity, especially among institutional players. After years of regulatory ambiguity, the tide seems to be turning in favor of blockchain-based innovation.

How Ripple’s Hidden Road Deal Adds Trust to the Crypto Industry

Critics might say that Ripple is abandoning decentralization by aligning with TradFi. But that misses the point. This isn’t capitulation—it’s evolution.

The Ripple–Hidden Road merger is the kind of deal that adds credibility, not compromises principles. It ensures that the underlying tech gets real-world usage, not just whitepapers and testnets.

And if there’s one thing the crypto space needs now, it’s pragmatic growth. Not just memes and yield farms. But robust infrastructure, real capital flows, and high-grade compliance. That’s how the next wave of adoption happens.

With the SEC case (mostly) behind them and this acquisition locked in, Ripple is setting itself up to lead the tokenization of real-world assets, the next evolution of capital markets. Think tokenized stocks, tokenized treasuries, even cross-border lending—all powered by a blockchain that’s already proven its mettle under fire.

What Ripple’s $1.25B Hidden Road Buy Means for Retail Investors

If you’re a retail investor, here’s why this matters:

- XRP is no longer just a speculative play. It’s part of an emerging financial backbone.

- Stablecoins like RLUSD may become trade settlement tools for everything from stocks to forex—giving crypto assets direct economic utility.

- DeFi and TradFi are converging, and Ripple is becoming the hub.

This move raises the floor for the entire space. It brings regulatory clarity, Wall Street-grade risk controls, and real-world asset utility to crypto holders—while making legacy institutions reckon with the speed and efficiency of blockchain tech.

So while meme coins might keep the headlines spicy, it’s deals like this that build the crypto economy of the next decade.

Final Thoughts: Ripple and Hidden Road Signal Crypto’s Next Era

Ripple’s acquisition of Hidden Road isn’t just a merger—it’s a message. A $1.25 billion message that says:

“We’re not just surviving regulation. We’re building the future of finance.”

It’s a message to Wall Street: we’re here, we’re funded, and we’re ready to scale.

And it’s a message to retail: this space is evolving fast. The builders aren’t backing down—they’re doubling down.

Ripple just went all in. The rest of the market should pay attention.

Disclaimer: This article is for informational purposes only. It is not financial advice. Always do your own research (DYOR) before investing in cryptocurrencies.

Mihajlo Tošić is a content writer specializing in iGaming, crypto, and Web3. He focuses on clear, direct writing that helps brands explain, sell, or promote what they do — without overcomplicating things.