EU Leaders Slam Trump’s “Liberation Day” Tariffs, Eye Retaliation Targeting U.S. Digital Assets

Key Takeaways

- Trump’s new tariffs impact allies as well as rivals, triggering outrage in the EU.

- European leaders are considering freezing or limiting U.S. crypto investments in response.

- Projects like XRP, Solana, and SUI are among the hardest hit in early trading fallout.

- Analysts fear the U.S. may isolate itself economically if such policies persist.

Global Markets Rattled by Trump’s Tariff Blitz

The European Union is poised to strike back after U.S. President Donald Trump implemented sweeping import tariffs in what he labeled as a “Liberation Day” initiative—a move that has disrupted diplomatic alliances and triggered global market volatility.

The tariffs, which affect major U.S. trading partners including the EU, Japan, and South Korea, have set off alarm bells across financial sectors, including cryptocurrency. While many expected global equities to nosedive further, markets appear to be cautiously pricing in the possibility of a policy reversal. But experts warn: Trump is unlikely to backtrack.

“Trump is a tariff man,” one analyst said. “This has been his consistent stance since the 1980s. He views trade deficits as national losses, and this latest round of tariffs reflects that belief.”

Europe Eyes U.S. Crypto as Retaliation Target

In response to the economic shockwave, EU leaders are signaling countermeasures, which could directly impact U.S.-based digital assets. French President Emmanuel Macron and Italian Prime Minister Giorgia Meloni have both condemned the U.S. policy.

Macron warned of a temporary freeze on French investments into U.S. markets, urging for a “unified European stance” to protect domestic interests. While still in early discussion, EU retaliation may include restrictions or taxation on U.S. crypto assets like XRP, SUI, and Solana—projects that are already reeling from recent double-digit losses.

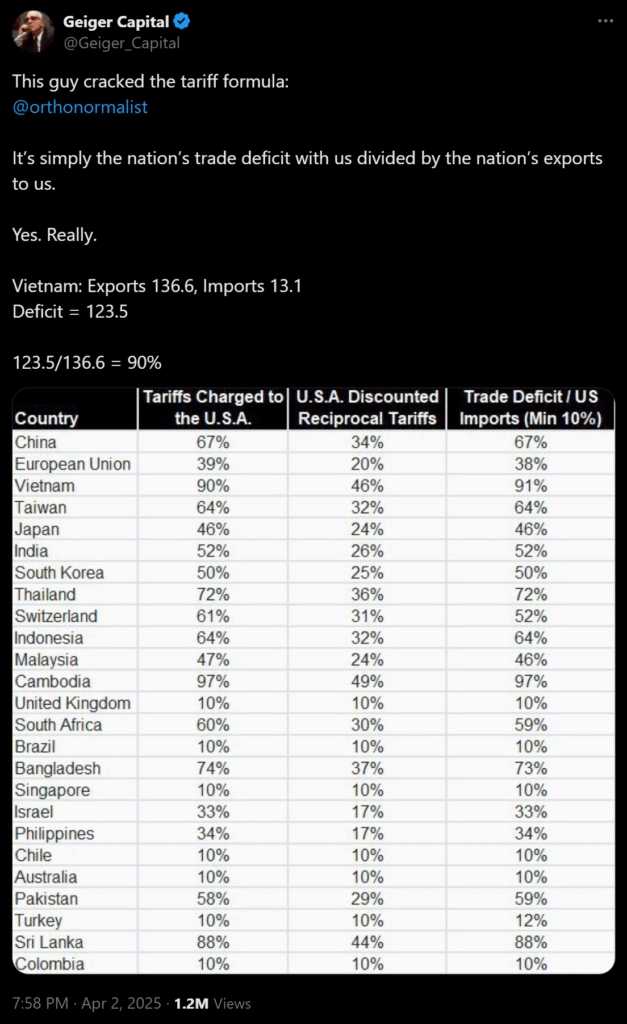

Tariffs Explained: Targeting Trade Deficits

The Trump administration’s tariff model is simple but aggressive: trade deficit ÷ U.S. exports. If you export a lot to the U.S. but buy little in return, you’re hit hardest. Here are some alarming ratios:

- Cambodia: $321.6M exported from the U.S. vs. $12.7B imported = ~3% return

- Vietnam: $13.1B vs. $136.6B = ~10%

- Sri Lanka: $368.2M vs. $3B = ~12%

These nations—once hailed as alternatives to Chinese manufacturing—now face levies as high as 49%. While the administration argues that tariffs will reshore U.S. manufacturing, economists warn that blanket hikes without incentives could backfire.

EU Leaders Warn of Blowback

European officials argue that such heavy-handed tariffs not only alienate allies but risk pushing countries into economic coalitions that exclude the U.S. entirely.

“It’s now worse to be a U.S. ally than an adversary,” said Thitinan Pongsudhirak of Thailand’s Chulalongkorn University. “At least adversaries know what to expect.”

Meanwhile, analysts at Deutsche Bank have noted that the U.S. may suffer more than Europe if global backlash solidifies into coordinated resistance—especially in sensitive sectors like tech, finance, and crypto.

Crypto Sector Braces for Policy Whiplash

The crypto market, already jittery from global economic uncertainty, now faces the additional burden of geopolitical weaponization. Should EU member states follow through on punitive financial measures, U.S. crypto platforms and assets could see reduced foreign participation, increased regulatory barriers, or frozen institutional investments.

Projects like Solana and SUI, with substantial U.S. developer presence and global investor bases, stand particularly vulnerable to such fractures.

Final Thoughts: Tariffs, Tensions, and Token Fallout

Trump’s tariff campaign might aim to boost U.S. industry, but its blunt execution risks fragmenting international markets, alienating key allies, and destabilizing sectors like crypto that thrive on cross-border participation.

Unless there’s a diplomatic detente, the EU’s evolving posture could redefine how international capital interacts with American blockchain projects.

Disclaimer: This article is for informational purposes only. It is not financial advice. Always do your own research (DYOR) before investing in cryptocurrencies.

Filip is a copywriter for startups and B2B SaaS. He’s also been working as a marketer for a variety of crypto projects since 2020.