Key Takeaways

- OKX’s European arm, OKCoin Europe Ltd., has been fined €1.05M ($1.2M) by Maltese authorities for anti-money laundering violations.

(Source: CoinDesk) - The FIAU investigation cited lapses in risk assessment for stablecoins, privacy tokens, and crypto mixers.

(Source: Cointelegraph) - Despite the fine, the FIAU noted significant improvements in OKX’s compliance program over the past 18 months.

- OKX remains MiCA pre-authorized in the EU, signaling broader institutional alignment.

In a move that signals increased scrutiny on crypto exchanges operating in Europe, Maltese financial watchdogs have slapped a $1.2 million fine on OKX’s European subsidiary, citing shortcomings in its anti-money laundering (AML) controls. The fine, handed down by Malta’s Financial Intelligence Analysis Unit (FIAU), follows a comprehensive audit of the exchange’s compliance framework.

As CoinDesk reports, the FIAU penalized OKCoin Europe Ltd. for “serious and systemic” deficiencies, particularly in risk assessments related to stablecoins, privacy tokens, and decentralized exchange (DEX) functionalities.

This case is not an isolated event—it’s a data point in the broader regulatory crackdown as global agencies seek to tame the sprawling crypto ecosystem without stifling innovation.

What Went Wrong: Breakdown of FIAU’s Findings

According to Cointelegraph’s coverage, the FIAU audit revealed that OKCoin:

- Failed to perform adequate risk assessments for newer, risk-sensitive crypto products like stablecoins and mixers.

- Neglected to define clear transaction monitoring protocols for high-risk wallet behavior.

- Showed weaknesses in enhanced due diligence (EDD) processes for high-volume or politically exposed accounts.

To be fair, the report did not allege active laundering—but in crypto, poor controls can be just as dangerous as bad actors. The fine reflects this shift toward holding platforms accountable not just for malicious behavior, but for insufficient safeguards.

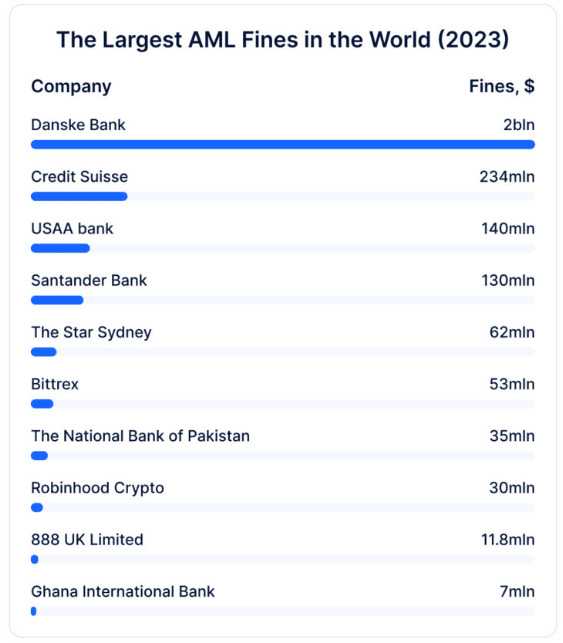

A Chart That Matters: Exchange Enforcement and AML Penalties (2022–2025)

Between 2022 and 2025, global regulators have escalated enforcement actions against major crypto platforms. From the U.S. SEC to EU watchdogs like Malta’s FIAU, the number of AML-related investigations and fines has more than tripled. The trend is especially sharp in jurisdictions with newly adopted frameworks like MiCA.

OKX Responds: Mea Culpa, but Eyes Still on Growth

In a formal statement, OKX said:

“We take our compliance obligations seriously and continue to enhance policies in line with evolving regulatory standards.”

And there’s a key silver lining here: even the FIAU acknowledged that OKX had made “material improvements” to its compliance program over the last 18 months—suggesting this penalty is more backward-looking than forward-damning.

Moreover, OKX remains pre-authorized under the EU’s MiCA framework, a distinction few exchanges can claim. This allows them to operate across EU member states once MiCA takes full effect. It’s not just a badge of compliance—it’s a strategic gateway into one of the world’s most sophisticated financial markets.

Pro Crypto View: Why This Isn’t a Death Blow

Let’s be clear—this isn’t FTX-level chaos. It’s a routine enforcement check with a fine that, while significant, is less than a rounding error for a platform of OKX’s size.

The takeaway for investors? Regulatory enforcement like this is a sign of ecosystem maturation, not decay.

Here’s why:

- MiCA-readiness is becoming the standard for serious crypto players in Europe.

- Fines clear regulatory overhangs, paving the way for future licensing and partnerships.

- Transparency ≠ weakness. When firms report fines, it shows they’re engaging with oversight—not avoiding it.

If anything, these penalties help clean the slate so exchanges can scale globally.

Related Article: https://tokenfest.io/ripple-goes-all-in-1-25-billion-bet-on-hidden-road-stuns-crypto-world/

Final Thoughts: Growing Pains Are a Feature, Not a Flaw

The OKX-Malta episode isn’t about whether crypto is failing—it’s about whether crypto is growing up.

Yes, $1.2M is a headline-worthy fine. But in the broader context, it’s a footnote in a story of increasing integration between Web3 and traditional finance. The more exchanges adapt, the more mainstream crypto becomes.

If you’re bullish on the space long-term, enforcement actions like this shouldn’t scare you—they should encourage you. Because compliant crypto is investable crypto. And that’s the future retail needs.

For further reading, check out Asian Markets Crumble, a Tokenfest trending news article.

This article is for informational purposes only and does not constitute financial advice. Always consult with a financial advisor before making any investment decisions.

Since 2023, Yoshi Ae has combined storytelling and community insight as a PR writer, creating content that resonates across platforms like X and Discord. From press releases to narrative campaigns, Yoshi bridges brand messaging with real-time community engagement.