Summary Highlights

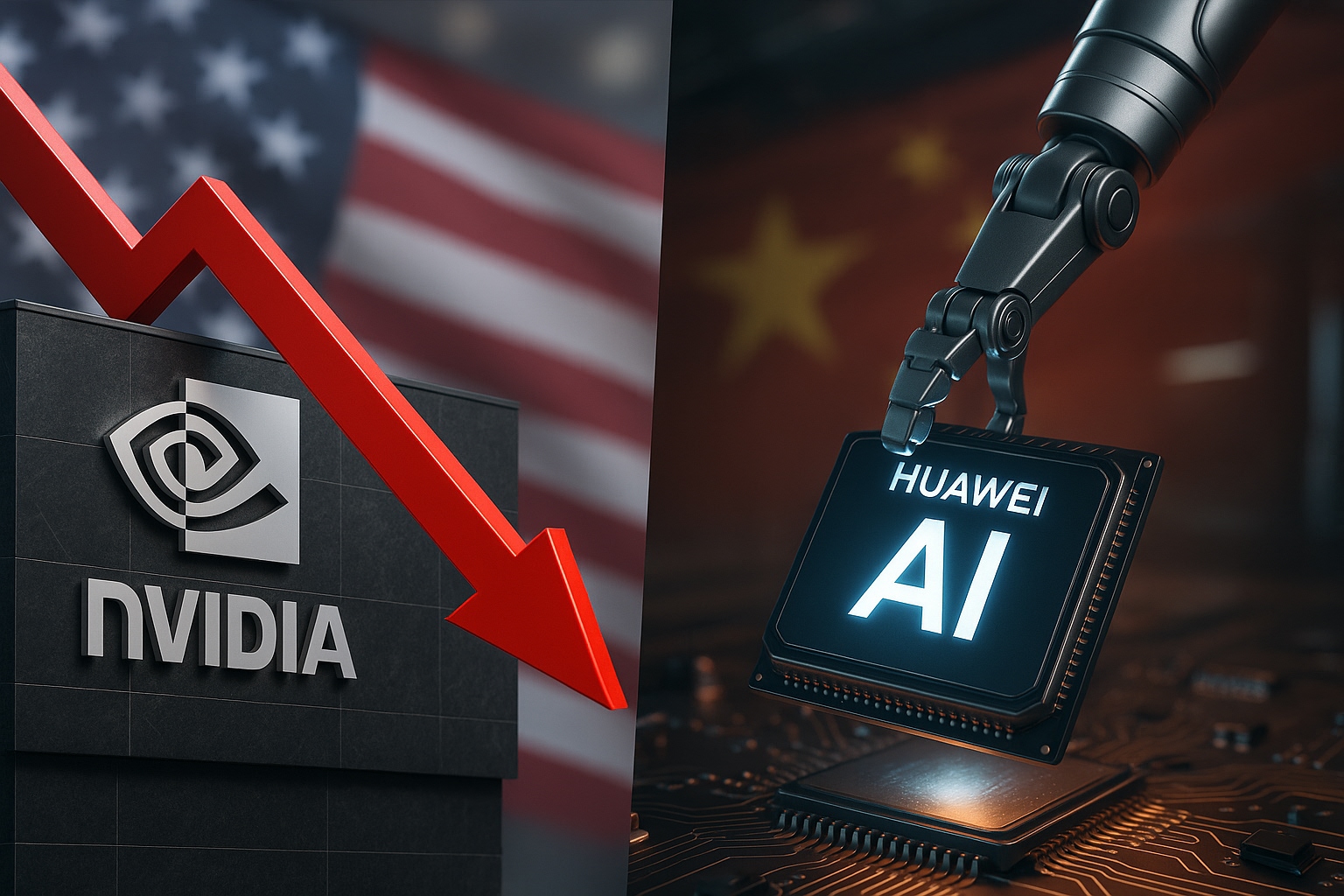

- Nvidia stock drops as Huawei unveils a new AI chip targeting enterprise and data centers.

- Ongoing U.S. tariffs on Chinese semiconductors may limit Nvidia’s near-term growth.

- Analysts warn of increased competition from China in the AI hardware race.

- Despite the dip, long-term sentiment on $NVDA remains cautiously optimistic.

Nvidia Hit by AI Chip War Escalation

Nvidia Corp. ($NVDA), the titan of GPU-based AI acceleration, saw its shares dip nearly 4% today amid breaking news that Huawei has officially launched a next-gen AI chip designed to rival Nvidia’s flagship offerings. The move, unveiled at a Beijing tech summit, signals China’s deeper commitment to reducing reliance on U.S. chipmakers.

The announcement coincides with growing fears of new U.S. tariffs on Chinese semiconductor imports, part of a broader strategy to curb Beijing’s rapid rise in AI and quantum computing capabilities. Nvidia’s exposure to Chinese markets — previously a major revenue driver — is once again under threat.

What Is Huawei’s AI Chip and Why It Matters

Huawei’s chip, named Ascend-X900, integrates neural compute acceleration, on-device fine-tuning, and high-bandwidth memory — directly competing with Nvidia’s H100 and GH200 platforms.

Chinese media outlets report that major tech firms and state-backed cloud services are preparing pilot programs using Ascend-X900, cutting off Nvidia’s ability to export advanced GPUs due to prior U.S. sanctions. If Huawei achieves mass-scale production, it could drastically shift AI compute market shares in Asia.

Tariffs Add More Pressure on $NVDA

The Biden administration is reportedly drafting a new round of tech-focused tariffs, with AI chips and semiconductor design tools on the list. While Nvidia has shifted some production to Vietnam and Taiwan to mitigate risks, it still relies heavily on cross-border silicon ecosystems.

According to Morgan Stanley analysts, Nvidia’s forward guidance could be trimmed if restrictions on chip exports to China expand beyond current limits. The company’s revenue exposure to China still hovers around 20%–25%.

NVDA Stock Forecast: Correction or Beginning of a Broader Pullback?

Despite today’s drop, analysts view the stock’s fundamentals as intact — driven by:

- AI infrastructure growth in U.S. data centers

- Strategic partnerships (Microsoft, Meta, Amazon Web Services)

- Expansion into automotive AI and robotics

That said, increased geopolitical friction could temper valuation multiples, making Nvidia a more volatile play in the short term. Institutional investors may watch the May 2025 earnings closely for revised guidance.

Analyst Take: What’s Next for Nvidia?

Nvidia’s innovation engine — from CUDA ecosystems to DGX platforms — gives it a durable edge. But pressure from state-subsidized competitors like Huawei may shift the margin game in international markets.

Whether Nvidia can maintain its valuation premium will depend on:

- U.S. policy direction post-2024 elections

- AI chip exclusivity agreements with hyperscalers

- Advances in proprietary interconnect tech (like NVLink 5.0)

Final Word

Nvidia is no stranger to volatility. Yet, with the AI arms race heating up globally, the next few quarters could define its long-term trajectory in markets outside the U.S. Traders and investors should closely watch how Nvidia counters Huawei’s momentum — and how Washington’s tariff stance evolves.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Since 2023, Yoshi Ae has combined storytelling and community insight as a PR writer, creating content that resonates across platforms like X and Discord. From press releases to narrative campaigns, Yoshi bridges brand messaging with real-time community engagement.