Quick Takeaways

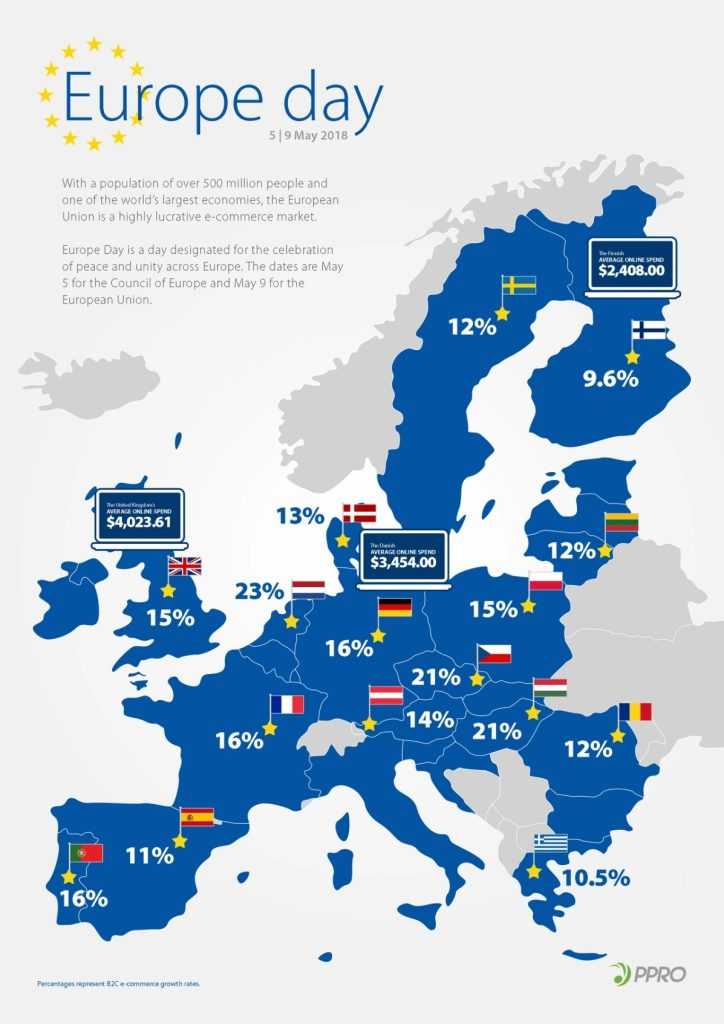

- Mastercard and Kraken have partnered to launch crypto debit cards in the UK and Europe.

- The collaboration enables Kraken users to spend cryptocurrencies at over 150 million Mastercard-accepting merchants.

- This initiative aims to bridge the gap between digital assets and everyday transactions, enhancing crypto utility.

Introduction

In a significant move towards mainstream cryptocurrency adoption, Mastercard and Kraken have announced a partnership to introduce crypto debit cards across the United Kingdom and Europe. This collaboration allows Kraken users to spend their digital assets seamlessly at millions of merchants that accept Mastercard, marking a pivotal step in integrating cryptocurrencies into daily financial activities.

Bridging Crypto and Traditional Finance

The partnership between Mastercard and Kraken is designed to simplify the use of cryptocurrencies for everyday purchases. By leveraging Mastercard’s extensive payment network and Kraken’s robust crypto platform, users can now utilize their digital assets for transactions at over 150 million locations worldwide. This initiative not only enhances the practicality of cryptocurrencies but also signifies a growing acceptance of digital assets in traditional financial systems.

Expanding Crypto Payment Infrastructure

Kraken Pay and the Introduction of Crypto Debit Cards

Building upon the success of Kraken Pay, a feature that facilitates instant and borderless payments in over 300 cryptocurrencies and fiat currencies, the partnership will soon introduce both physical and digital debit cards. These cards will be directly linked to users’ Kraken accounts, enabling real-time conversion of crypto to fiat at the point of sale. This development aims to eliminate the complexities associated with crypto transactions, making them as straightforward as traditional card payments.

Ensuring Security and Regulatory Compliance

Implications for Crypto Adoption

This collaboration represents a significant advancement in the practical use of cryptocurrencies. By facilitating everyday transactions with digital assets, Mastercard and Kraken are not only enhancing the utility of cryptocurrencies but also paving the way for broader adoption. As regulatory clarity improves and infrastructure matures, such partnerships are instrumental in transitioning cryptocurrencies from speculative investments to functional financial tools.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Filip is a copywriter for startups and B2B SaaS. He’s also been working as a marketer for a variety of crypto projects since 2020.