Altcoins — or “alternative coins” — refer to any cryptocurrency that isn’t Bitcoin. With thousands of projects in circulation today, altcoins can offer exciting investment opportunities, from utility tokens to DeFi coins and even meme-based assets. But navigating how to buy them, especially if you’re new to the space, can feel overwhelming.

This guide is here to simplify the process. Whether you’re aiming to invest in a top-50 project or a lesser-known gem, this step-by-step walkthrough will help you get started with confidence.

What You Need to Know Before Buying

Before jumping in, it’s important to understand a few basics:

- Volatility is the norm: Altcoins can see major price swings in short periods. They can rise dramatically on hype or fall just as quickly on negative news or lack of liquidity.

- Do your own research (DYOR): Not all coins are equal. Some have real-world use cases and teams behind them, while others are simply speculative. Read whitepapers, check out roadmaps, and verify community activity on platforms like X (formerly Twitter), Discord, or Telegram.

- Scams exist: Be cautious of pump-and-dump schemes or tokens without real value. If a coin is being aggressively promoted with promises of guaranteed returns, it’s probably best to steer clear.

Also, understand the type of altcoin you’re buying:

- Utility tokens (e.g., UNI, LINK) are used within specific platforms or ecosystems

- Governance tokens give holders a say in the future of a protocol

- Stablecoins are pegged to fiat currencies

- Meme coins are often purely speculative

Step 1: Set Up a Crypto Wallet

You’ll need a wallet to store your altcoins. Here are two types to consider:

- Software wallets: These are apps or browser extensions like MetaMask, Trust Wallet, or Phantom (for Solana). Easy to use and accessible.

- Hardware wallets: Physical devices such as Ledger or Trezor. These offer a high level of security since they’re offline and less vulnerable to hacks.

Always back up your seed phrase securely. Never share it with anyone — not even tech support.

Step 2: Buy a Base Crypto (BTC, ETH, or USDT)

Altcoins are commonly traded against major cryptocurrencies or stablecoins. To buy them, you typically need to start by purchasing:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT) or USD Coin (USDC)

You can acquire these via:

- Centralized exchanges (CEX): Like Coinbase, Binance, Kraken, and Bybit. These platforms allow you to fund your account with fiat (USD, EUR, etc.) and buy crypto.

- Peer-to-peer (P2P) platforms: Where users trade directly with one another. Binance P2P and LocalBitcoins are popular examples.

Some exchanges offer zero-fee purchases or sign-up bonuses, so shop around before committing.

Step 3: Transfer to a Trading Platform

Once you’ve purchased your base currency, the next step is to send it to an exchange that lists the altcoin you’re interested in. Make sure you:

- Check if the exchange supports the altcoin

- Verify the correct blockchain network (e.g., BNB Smart Chain, Ethereum, Solana)

Top altcoin-friendly exchanges:

- Binance (wide selection and strong liquidity)

- KuCoin (great for early-stage altcoins)

- Gate.io (frequently lists newer tokens)

- MEXC Global (emerging markets and DeFi focus)

Take care to copy-paste your wallet addresses accurately. Mistakes can be irreversible.

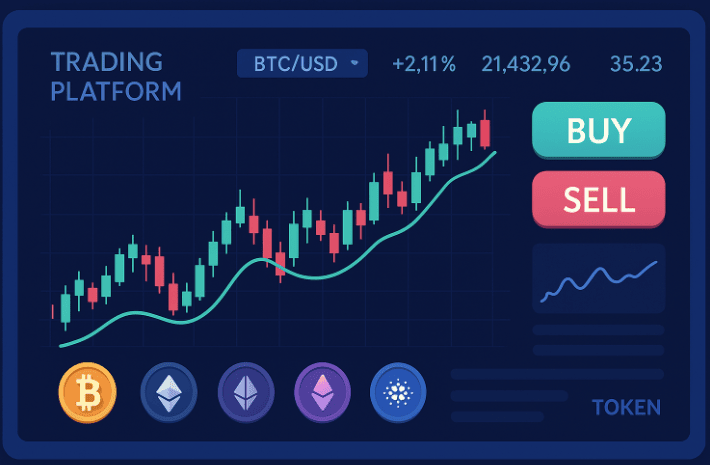

Step 4: Place Your Trade

Now you’re ready to make your trade. Most platforms provide both basic and advanced trading interfaces.

- Login to your exchange account

- Go to the spot trading section

- Search for the trading pair (e.g., ETH/XYZ or USDT/XYZ)

- Select a market order (executes immediately) or limit order (you set the price)

- Input the amount you want to buy and click Buy

Once completed, your altcoins will appear in your exchange wallet.

Step 5: Transfer to Your Personal Wallet

If you plan to hold your altcoins long-term, it’s safer to withdraw them to your personal wallet. This reduces your exposure to exchange hacks or sudden platform shutdowns.

Steps:

- Open your personal wallet and copy the wallet address

- In your exchange, go to Withdraw and paste the address

- Select the correct network (always triple-check)

- Enter the amount and confirm the transaction

Depending on the network, your tokens should arrive within a few minutes to an hour.

Bonus Tip: Explore Decentralized Exchanges (DEXs)

Some altcoins never get listed on centralized platforms. If that’s the case, use a DEX:

- Uniswap (for Ethereum-based tokens)

- PancakeSwap (for BNB Chain tokens)

- SushiSwap, Raydium, Trader Joe, and others depending on the chain

DEX transactions require:

- Connecting your wallet

- Having native tokens (e.g., ETH or BNB) to pay for gas fees

- Using a verified contract address to avoid scam tokens

DEXs give access to the “long tail” of altcoins — the ones that could pop off before they hit CEXs.

Tax and Regulation Considerations

Depending on where you live, profits from altcoin trading may be taxable. Keep track of:

- Dates of purchase and sale

- Token values at the time of transactions

- Platform used for the trade

Tools like Koinly, CoinTracker, or Accointing can help automate this.

Also, ensure you’re using exchanges and wallets that comply with your country’s regulations.

Final Thoughts

Buying altcoins is easier than ever — but it comes with responsibility. Take time to understand the project, protect your assets, and never invest more than you’re willing to lose.

Whether you’re diversifying your portfolio or experimenting with new tech, altcoins offer a chance to explore the future of decentralized finance, gaming, identity, and more. Just be smart, stay informed, and enjoy the ride.

Disclaimer: This guide is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.

Filip is a copywriter for startups and B2B SaaS. He’s also been working as a marketer for a variety of crypto projects since 2020.