Key Takeaways

- Florida’s House Insurance and Banking Subcommittee has unanimously advanced House Bill 487, proposing the allocation of up to $1.5 billion in public funds into Bitcoin.

- The bill allows investments through direct holdings, custodial accounts, or regulated exchange-traded products, with a cap of 10% per fund.

- This legislative action positions Florida at the forefront of state-level cryptocurrency adoption, potentially influencing other states to consider similar measures.

Introduction

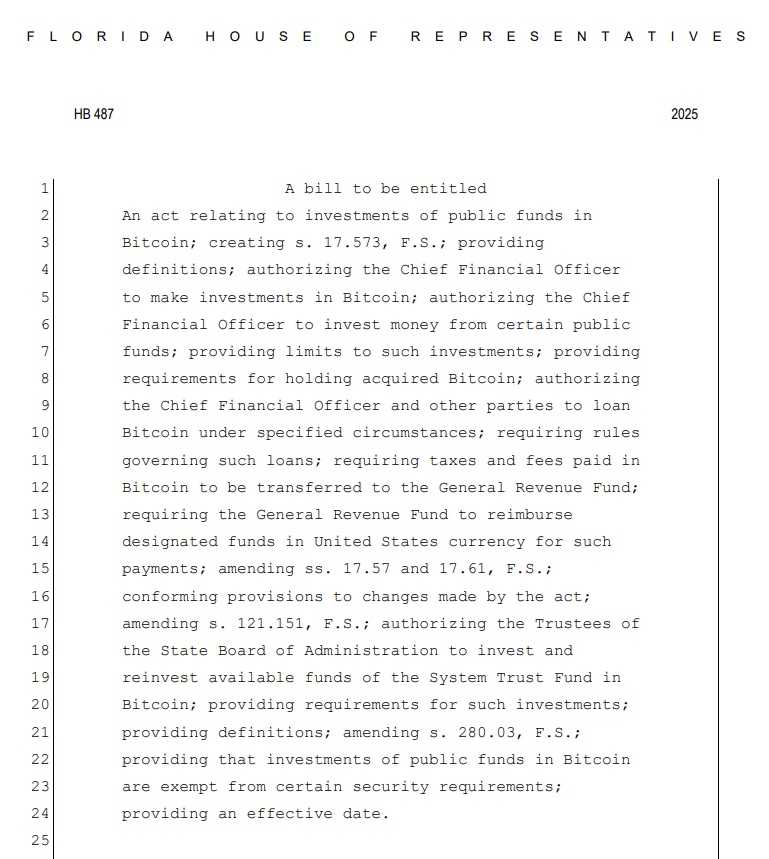

In a significant development for cryptocurrency adoption, Florida’s legislature is considering a groundbreaking move to invest state funds in Bitcoin. House Bill 487, recently advanced by the House Insurance and Banking Subcommittee, proposes allocating up to $1.5 billion of public funds into Bitcoin, marking a historic step in integrating digital assets into state financial strategies.

Legislative Details

Sponsored by Representative Webster Barnaby, HB 487 authorizes Florida’s Chief Financial Officer to invest in Bitcoin through various means, including direct holdings, custodial accounts, or regulated exchange-traded products. The bill stipulates that no more than 10% of any fund’s total balance can be allocated to Bitcoin investments, ensuring a measured approach to diversification.

The legislation also outlines provisions for securely holding the acquired Bitcoin and allows for the possibility of loaning the assets to generate additional returns, provided such actions do not pose increased financial risk.

Florida’s Legislative Progress

Broader Implications

Florida’s initiative reflects a growing trend among U.S. states exploring the integration of Bitcoin into public fund investments. The move is seen as a strategic effort to hedge against inflation and diversify the state’s investment portfolio. If enacted, Florida would join a select group of states taking proactive steps toward embracing digital assets at the governmental level.

The bill’s advancement has already had a noticeable impact on the cryptocurrency market, with Bitcoin’s price climbing above $83,000 following the announcement.

Conclusion

Florida’s consideration of Bitcoin investments represents a bold and forward-thinking approach to state financial management. By potentially allocating a portion of public funds into digital assets, the state is not only diversifying its portfolio but also signaling a broader acceptance of cryptocurrency’s role in the modern financial landscape. As the bill progresses through the legislative process, its outcome could set a precedent for other states contemplating similar strategies.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Mihajlo Tošić is a content writer specializing in iGaming, crypto, and Web3. He focuses on clear, direct writing that helps brands explain, sell, or promote what they do — without overcomplicating things.