Key Takeaways

- First Trust launches two new Bitcoin strategy ETFs—BFAP and DFII—designed to offer upside exposure with risk-managed or income-generating strategies. (Source)

- BFAP offers a 15% downside floor over a 12-month period while tracking Bitcoin price upside with a cap.

- DFII seeks to generate 15%+ income annually by writing covered calls on Bitcoin-linked assets.

- Launch comes as investors demand safer crypto-linked investments during volatile markets.

Morningstar reports that First Trust Advisors L.P., a heavyweight in the ETF industry, is stepping boldly into the crypto space—at a time when many investors are running scared.

On April 4, 2025, the firm launched two Bitcoin-linked exchange-traded funds (ETFs)—the FT Vest Bitcoin Strategy Floor15 ETF (BFAP) and the FT Vest Bitcoin Strategy & Target Income ETF (DFII)—targeting investors hungry for BTC exposure, but not the wild drawdowns.

“Investors want Bitcoin, but without the 50% drawdowns,” said Ryan Issakainen, CFA and ETF Strategist at First Trust. “These ETFs offer a smarter way to approach crypto.”

Why Now? Why Bitcoin ETFs?

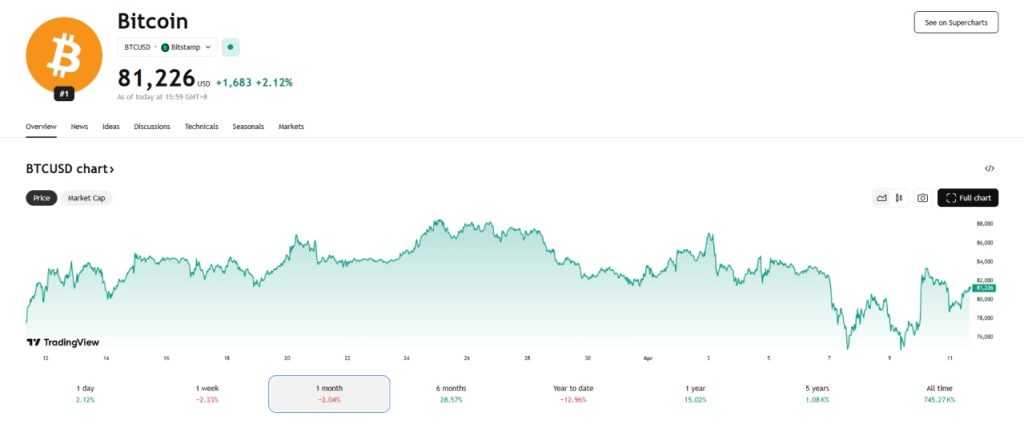

The crypto market has recently faced brutal volatility, with Ethereum dipping to 8.8% dominance and altcoins bleeding across the board. Despite this, Bitcoin continues to draw capital from institutions and ETF issuers alike.

With over $93 billion already managed across U.S. Bitcoin ETFs in 2025, First Trust is not late to the game—they’re raising the bar with structured risk control and yield generation.

And yes, that’s real Bitcoin exposure—just layered with strategy.

Breaking Down the ETFs

BFAP – “Safety First” for Bitcoin Bulls

- Ticker: BFAP

- Strategy: Tracks Bitcoin upside with a 15% downside protection over a 12-month term.

- Cap: Performance is capped, but investors gain from any rise in BTC price—up to the cap.

- Holds: U.S. Treasuries, cash, and options—not spot BTC.

Translation: It’s Bitcoin exposure for people who want to sleep at night.

Related Article: https://tokenfest.io/trumps-tariff-war-reignites-bitcoin-hype-could-btc-outlast-the-us-dollar/

DFII – “Yield From Crypto Volatility”

- Ticker: DFII

- Strategy: Generates targeted annual income of 15%+ by selling covered calls on BTC exposure.

- Focus: Designed for yield-hunters looking to earn passive income from crypto markets.

In a year when even Treasuries look shaky, this strategy taps into Bitcoin’s legendary volatility to produce returns without chasing price pumps.

More details at FT Portfolios

Risk-Managed Crypto: A Growing Trend

Traditional investors—especially boomers and institutions—have largely stayed out of the crypto sandbox. The reasons? Too risky. Too confusing. Too unregulated.

These new ETFs could change the game. They don’t hold Bitcoin directly, so they avoid regulatory pitfalls, use classic financial instruments, and deliver performance in a familiar wrapper: the ETF.

They follow the lead of recent hybrid offerings, like the Galaxy Inverse Bitcoin ETF, proving that Wall Street and crypto are learning to co-exist.

Bullish Implications: Smart Money Is Still Betting on BTC

Make no mistake—this launch isn’t some speculative gamble. It’s a strong signal that institutional players believe Bitcoin is here to stay—they’re just looking for smarter ways to play.

In fact, the timing couldn’t be better. As Fed rate cuts loom and fiat debasement fears persist, crypto-native assets like BTC are becoming more relevant—not less.

The fact that a $200B asset manager is building Bitcoin ETFs with capital preservation and yield in mind? That’s institutional validation—and it’s bullish.

TL;DR for Retail: Is It Worth It?

If you’re a retail investor unsure about diving headfirst into crypto, BFAP and DFII offer a lower-risk, higher-comfort entry point:

- Want Bitcoin growth with guardrails? Go BFAP.

- Prefer income over speculation? Try DFII.

- Still hodling on the sidelines? These ETFs may be your invitation to the party.

Final Thoughts

First Trust’s ETFs prove one thing: crypto is evolving. No longer just the Wild West of finance, it’s being wrapped in regulated, optimized, and risk-managed strategies designed for the everyday investor.

And whether you’re an OG Bitcoin maxi or a newbie still figuring out what a “wallet” is—there’s never been a better time to start getting exposure.

Because if there’s one thing the market teaches us again and again—it’s that when smart money moves in, it’s worth watching.

Note: This article reflects market conditions and forecasts as of April 11, 2025. Crypto markets are inherently volatile. Readers are encouraged to do their own research before making investment decisions.

Since 2023, Yoshi Ae has combined storytelling and community insight as a PR writer, creating content that resonates across platforms like X and Discord. From press releases to narrative campaigns, Yoshi bridges brand messaging with real-time community engagement.