Key Takeaways

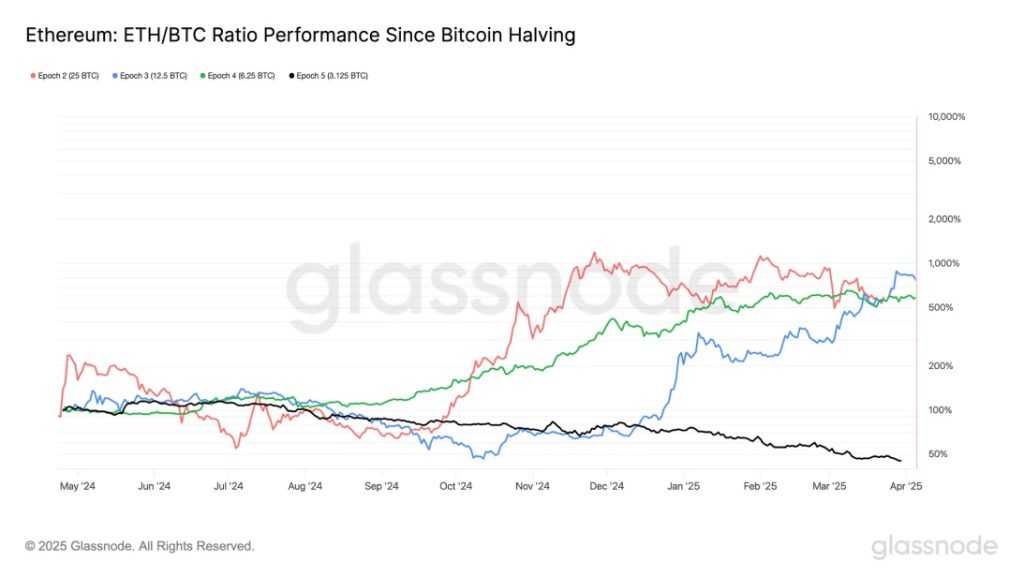

- The ETH/BTC ratio has declined to 0.02193, marking its lowest point since May 2020.

- Ethereum’s underperformance is attributed to factors like increased inflationary pressures and reduced network activity.

- Despite current challenges, some analysts anticipate a potential rebound for Ethereum in the coming months.

Introduction

Ethereum’s performance relative to Bitcoin has reached a significant low, with the ETH/BTC ratio dropping to levels not seen in over four years. This decline reflects a combination of macroeconomic factors and internal challenges within the Ethereum network.

Factors Contributing to Ethereum’s Underperformance

Several elements have contributed to Ethereum’s recent struggles:

- Inflationary Pressures: Post-Merge, Ethereum was anticipated to become deflationary. However, recent data indicates an average supply growth rate of 5.4% since February 2024, undermining this expectation.

- Reduced Network Activity: Ethereum’s monthly fees dropped to $22 million in March 2025, the lowest since June 2020, signaling decreased user engagement and network utilization.

- Institutional Preference for Bitcoin: The approval and subsequent success of Bitcoin ETFs have attracted significant institutional investment, overshadowing Ethereum’s offerings in this space.

ETH/BTC Ratio Decline

Analyst Perspectives

Despite the downturn, some analysts maintain a cautiously optimistic outlook for Ethereum:

- Sean Dawson, Head of Research at Derive.xyz, notes a “mildly positive sentiment” for ETH in the medium to long term, citing bullish options market indicators.

- VentureFounder, a crypto analyst, suggests that Ethereum’s current price action mirrors patterns seen in previous market cycles, potentially indicating an approaching bottom.

Comparative Performance

While Bitcoin has experienced a 121.4% increase over the past year, Ethereum’s growth has been more modest at 46.29%. This disparity highlights the shifting dynamics within the cryptocurrency market and the challenges Ethereum faces in maintaining its position.

Conclusion

Ethereum’s recent performance against Bitcoin underscores the evolving landscape of the cryptocurrency market. While current indicators point to challenges ahead, the foundational strengths of the Ethereum network and ongoing developments may pave the way for a resurgence. Investors and enthusiasts alike will be watching closely to see how Ethereum navigates this period and positions itself for future growth.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Andrej is an experienced content and copywriter who’s been creating impactful, engaging content since 2022. Though he’s worked across various of industries, he specializes in Crypto, Web3, and SaaS. From in-depth blog posts to high-converting web copy, he combines strategic thinking with a natural flair for storytelling to deliver content that not only informs but also resonates with readers