Key Takeaways

- Ethereum’s market dominance has fallen to 8.8%, marking its lowest level since May 2020.

(CryptoSlate) - Whales are actively accumulating ETH, signaling long-term confidence in the asset despite short-term price weakness.

(Decrypt) - This trend points to a potential bullish reversal, with strategic accumulation typically preceding market rebounds.

- On-chain data and behavioral patterns suggest that smart money is positioning ahead of Ethereum’s next big cycle.

- For retail investors, the current dip could represent an opportunity—not a threat.

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is experiencing a notable shift in market dynamics. Recent data indicates that Ethereum’s market dominance has declined to 8.8%, marking its lowest point since May 2020. This downturn comes amid a broader market recalibration, with Bitcoin (BTC) strengthening its position and capturing a larger share of the cryptocurrency market.

Market Dynamics and Ethereum’s Position

The cryptocurrency market is inherently volatile, with dominance metrics often fluctuating based on investor sentiment, technological developments, and macroeconomic factors. Ethereum’s recent dip in market dominance can be attributed to several factors:

- Bitcoin’s Resurgence: Bitcoin has seen a resurgence in investor interest, bolstered by its perceived status as a ‘digital gold’ and a hedge against inflation. This renewed focus has led to an increased allocation of capital towards BTC, thereby impacting Ethereum’s market share.

- Regulatory Developments: Regulatory scrutiny in various jurisdictions has introduced uncertainty, affecting investor confidence and leading to shifts in portfolio allocations.

- Technological Upgrades: Ethereum’s ongoing transition to Ethereum 2.0 and the implementation of proof-of-stake mechanisms have introduced both optimism and caution among investors, influencing market dynamics.

Whale Accumulation: A Vote of Confidence

Amidst the backdrop of declining market dominance, an intriguing trend has emerged: large-scale investors, colloquially known as ‘whales,’ are actively accumulating Ethereum. On-chain data reveals significant accumulation patterns, suggesting that these investors are capitalizing on the current price levels to bolster their ETH holdings.

This behavior is indicative of a strong belief in Ethereum’s long-term value proposition. Whales often have access to sophisticated market analysis and resources, and their accumulation strategies can serve as a bellwether for broader market sentiments.

Implications for Retail Investors

For retail investors, the current market conditions present both challenges and opportunities:

- Long-Term Potential: The accumulation of ETH by whales may signal a bullish outlook for Ethereum’s future. Retail investors might consider this as a positive indicator when formulating their investment strategies.

- Market Volatility: It’s essential to remain cognizant of the inherent volatility in the cryptocurrency market. While whale accumulation can be a positive sign, it doesn’t eliminate the risks associated with market fluctuations.

- Diversification: Diversifying one’s portfolio can help mitigate risks. Considering a mix of assets, including both cryptocurrencies and traditional investments, can provide a balanced approach.

Expert Insights

Analysts are observing these developments closely. A CryptoQuant analyst noted, “This is [a] time when accumulation whales are likely to respond to market fear, indicating a potential V-shaped rebound.” This perspective underscores the potential for a market recovery driven by strategic accumulation.

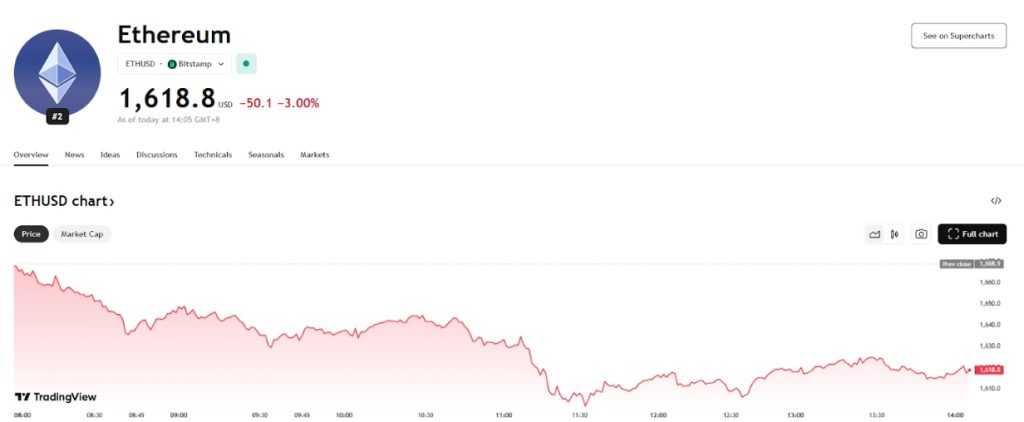

Visual Representation

To provide a clearer picture of Ethereum’s current market performance, below is a recent price chart illustrating ETH’s price movements:

Conclusion

While Ethereum’s market dominance has experienced a decline, the active accumulation by whales suggests a prevailing confidence in its long-term potential. Retail investors should interpret these signals within the context of their individual investment goals and risk tolerance. As always, staying informed and adopting a strategic approach is paramount in navigating the dynamic cryptocurrency landscape.

Disclaimer: This article is for informational purposes only. It is not financial advice. Always do your own research (DYOR) before investing in cryptocurrencies.

Andrej is an experienced content and copywriter who’s been creating impactful, engaging content since 2022. Though he’s worked across various of industries, he specializes in Crypto, Web3, and SaaS. From in-depth blog posts to high-converting web copy, he combines strategic thinking with a natural flair for storytelling to deliver content that not only informs but also resonates with readers