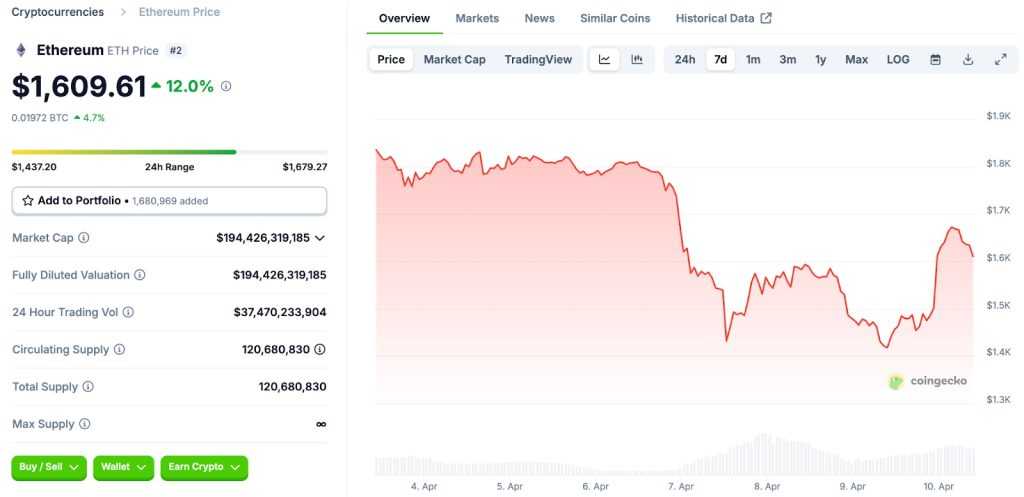

- Ethereum ETFs Experience Significant Outflows: Over the past two weeks, Ethereum exchange-traded funds (ETFs) have seen outflows totaling approximately $85.3 million, raising concerns about investor confidence. Source: Coinpedia

- Market Volatility Amid Economic Uncertainty: The cryptocurrency market has been experiencing heightened volatility, influenced by factors such as trade tensions and macroeconomic indicators.

- Comparative Performance with Bitcoin ETFs: In the same period, Bitcoin ETFs recorded net outflows of $1.14 billion, indicating a broader trend of caution among investors in cryptocurrency ETFs. Source: Coinpedia

- Potential Catalysts for Reversing Outflows: Analysts suggest that upcoming technological advancements and regulatory developments could bolster investor confidence in Ethereum. ETHNews

- Long-Term Outlook Remains Positive: Despite current outflows, the long-term prospects for Ethereum ETFs appear promising, with expectations of increased adoption and inflows in the future.

Source: Coingecko

In recent weeks, the cryptocurrency market has witnessed notable fluctuations, particularly concerning Ethereum exchange-traded funds (ETFs). Data indicates that Ethereum ETFs have experienced outflows amounting to approximately $85.3 million over the past two weeks, prompting discussions about the underlying factors influencing investor sentiment. Coinpedia Fintech News

This trend is not isolated to Ethereum alone. Bitcoin ETFs, for instance, have seen even more substantial outflows, with a staggering $1.14 billion exiting over the same period. Such movements suggest a broader sense of caution permeating the cryptocurrency investment landscape.

Several elements contribute to this cautious stance among investors. Global economic uncertainties, including trade tensions and fluctuating macroeconomic indicators, have played a significant role in shaping market dynamics. For example, recent trade volatility has led to notable price swings in major cryptocurrencies, with Bitcoin’s value dropping below $75,000 before rebounding. Business & Finance News India

Despite these short-term challenges, the long-term outlook for Ethereum remains optimistic. The network’s ongoing scalability upgrades and the increasing interest in decentralized finance (DeFi) applications position it favorably for future growth. Analysts anticipate that these developments could lead to a surge in Ethereum ETF inflows, potentially outpacing those of Bitcoin in the coming years. Cointelegraph

Moreover, the potential introduction of staking features within Ethereum ETFs could offer investors additional income streams, further enhancing the attractiveness of these investment vehicles. Such innovations are expected to bolster investor confidence and drive increased participation in the Ethereum ecosystem. MarketWatch

In conclusion, while recent outflows from Ethereum ETFs may raise concerns about waning investor confidence, it is essential to view these developments within the broader context of market dynamics and ongoing advancements within the Ethereum network. The foundation being laid today through technological improvements and potential regulatory support is likely to pave the way for a more robust and resilient Ethereum market in the future.

Note: This article reflects market conditions and forecasts as of April 10, 2025. Crypto markets are inherently volatile. Readers are encouraged to do their own research before making investment decisions.

Mihajlo Tošić is a content writer specializing in iGaming, crypto, and Web3. He focuses on clear, direct writing that helps brands explain, sell, or promote what they do — without overcomplicating things.