Key Takeaways

- 21Shares submits ETF proposal for Dogecoin, signaling rising institutional interest in memecoins

- DOGE price surged 14% on the news, breaking key resistance levels

- Industry analysts predict billions could flow in if SEC approves the ETF

- Move marks a critical moment for the legitimacy of memecoins in traditional finance

- DOGE now seen as more than a meme—potential institutional-grade digital asset

As highlighted by a recent filing with the SEC, Swiss-based crypto asset manager 21Shares has applied to construct the world’s first Dogecoin ETF (Exchange-Traded Fund) in the United States. The proposed financial product aims to track the price of Dogecoin (DOGE) and is labeled as “21Shares Core Dogecoin ETF.” The ETF seeks to provide classical investors with easier access to the memecoin.

This filing is not just an attempt to leverage the ongoing crypto hype—it can potentially unlock billions in capital and formally induct Dogecoin into the elite club of ETF crypto assets. Put simply, this means that Dogecoin may no longer be a joke.

“Dogecoin is a top 10 cryptocurrency with a market cap north of $20 billion. It’s earned a seat at the table,” said 21Shares co-founder Ophelia Snyder in a Bloomberg interview.

Why an ETF for Dogecoin?

Up until this moment, Dogecoin has had absolutely no exposure from institutions. While Bitcoin and Ethereum ETFs are now being introduced to both the spot and futures markets, Dogecoin has remained behind the curtain of its meme status. That could all change very soon.

21Shares is confident that there is actual demand from both retail and professional investors for a means to allocate capital towards Dogecoin without depending on centralized exchanges or moving through crypto wallets.

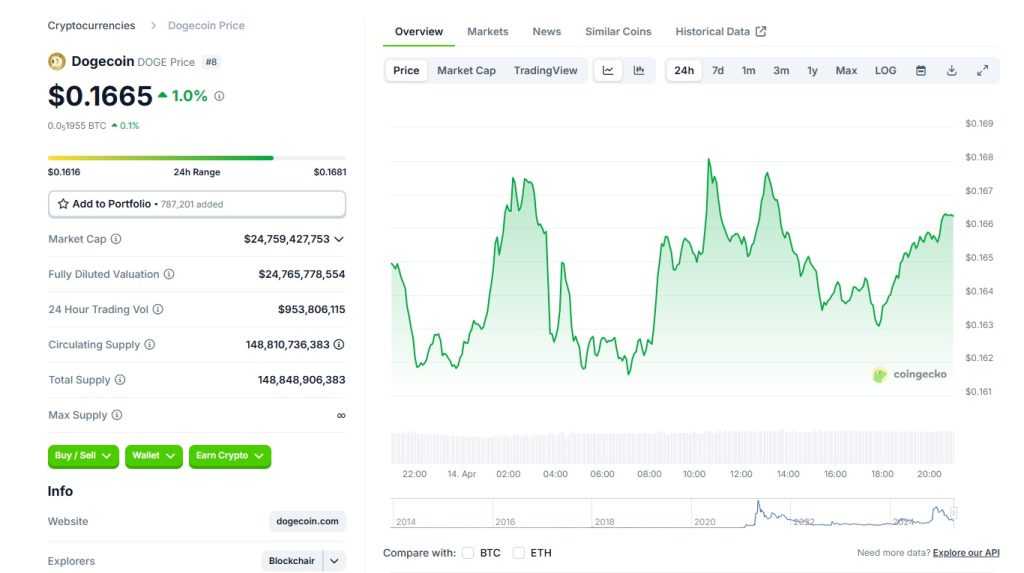

Source: https://www.coingecko.com/en/coins/dogecoin

The ETF filing specifies plans for the physical backing—21Shares plans to custodian the underlying DOGE which would create a 1:1 ratio between shares and the digital asset. This may create strong supply-side pressure on the Dogecoin markets and potentially provide a long-term equilibrium stabilizer for its price.

DOGE Price Reacts — And So Does the Market

Shortly after the news broke, DOGE saw an immediate 14% intraday price jump, pushing past the $0.22 resistance. On-chain data also shows whale wallet activity spiking, with a notable 9% increase in wallets holding over 10 million DOGE. The market clearly took the news as bullish.

Elon Musk, a long-time Dogecoin supporter, has yet to comment directly on the filing, but the Dogecoin community is already rallying. Here’s what Bankless co-founder Ryan Sean Adams had to say:

Potential for Billions in Capital Inflows

If the SEC accepts the filing, experts anticipate inflows from institutions between 1 to 5 billion within the first year and a half. This number is drawn from analogs with Bitcoin and Ethereum ETFs, although the unique risks—and opportunities—posed by Dogecoin’s volatility and pop cultural origins add a twist.

“Unlike most other cryptos, Dogecoin has cultural liquidity. That’s an asset,” said Jake Chervinsky, Chief Legal Officer at Variant Fund.

For retail investors, this means Dogecoin might soon be spendable from 401(k)s, Roth IRAs, and pension funds, which is the dream for any asset class.

This is akin to the effects we observed in the market when spot Bitcoin ETFs were approved earlier this year, which created a feedback loop of price legitimacy and price discovery. As noted in our latest article focused on institutional momentum in crypto, public exposure builds a very strong public relations machine.

What It Means for Memecoins as an Asset Class

Should it gain the green light, the 21Shares DOGE ETF might reset the entire memecoin category. Shiba Inu (SHIB), Floki, and even new entrants such as PepeCoin might begin to receive recognition from investment funds and asset management companies.

A change so radical is nothing short of “The institution of culture” as we have known it. What used to be a joke, memecoins are on the verge of transforming into bona fide asset classes supported by on-chain community fundamentals and off-chain financial wrappers.

In fact, ETF analyst Eric Balchunas compared it to the “Robinhood moment” for crypto:

“This is like GameStop in 2021, except it’s being filed with the SEC.”

When Will We Know More?

The SEC can take as long as 240 days to give a final verdict, but most analysts predict they will give the first feedback in 45–60 days. Following leadership changes, the agency has taken a more progressive stance, adopting the tendency to pressure embraced tokenization in traditional finance.

Until then, the crypto community will be watching and by the DOGE probably stacking DOGE. The next key date is June 7th, 2025, when the SEC is likely to give a preliminary ruling.

Conclusion: A Bullish Signal for Crypto’s Future

The Dogecoin ETF isn’t only focused on a single coin; it reflects on the ever-growing scope of crypto’s recognition in the worldwide financial markets. This filing changes the perception of what qualifies as a “serious” asset for everyone from a memecoin degen to a Wall Street fund manager.

21Shares is taking a risk with their investment thesis, claiming that the next surge of usage and adoption will stem not reguarded from sound money or smart contracts, but rather from powerful lasting memes.

If you’re predicting yet another Dogecoin reversal, don’t fade it just yet. The next billion-dollar inflow might just be barking up the right chain.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Since 2023, Yoshi Ae has combined storytelling and community insight as a PR writer, creating content that resonates across platforms like X and Discord. From press releases to narrative campaigns, Yoshi bridges brand messaging with real-time community engagement.