Key Takeaways

- China’s recent imposition of a 34% tariff on U.S. goods has significantly increased costs for Bitcoin mining operations.

- U.S.-based miners, heavily reliant on Chinese-manufactured ASIC hardware, face equipment cost increases of 22–36%.

- The tariffs may prompt a shift in global mining dynamics, potentially reducing the U.S.’s share of the Bitcoin hashrate.

Introduction

The escalating trade tensions between the United States and China have taken a new turn, with China’s recent imposition of a 34% tariff on U.S. goods. This move has sent shockwaves through various industries, notably impacting the Bitcoin mining sector, which relies heavily on Chinese-manufactured hardware.

Impact on Bitcoin Mining Operations

The U.S. Bitcoin mining industry, which accounts for approximately 40% of the global hashrate, is particularly vulnerable to these tariffs. The increased costs of importing essential mining equipment, such as ASIC machines, are squeezing profit margins and threatening the competitiveness of U.S.-based miners.

Jill Ford, founder of Bitford Digital, highlighted the severity of the situation, stating that U.S. miners are now facing a 22–36% increase in equipment costs due to the tariffs. This substantial rise in expenses could render many mining operations financially unsustainable.

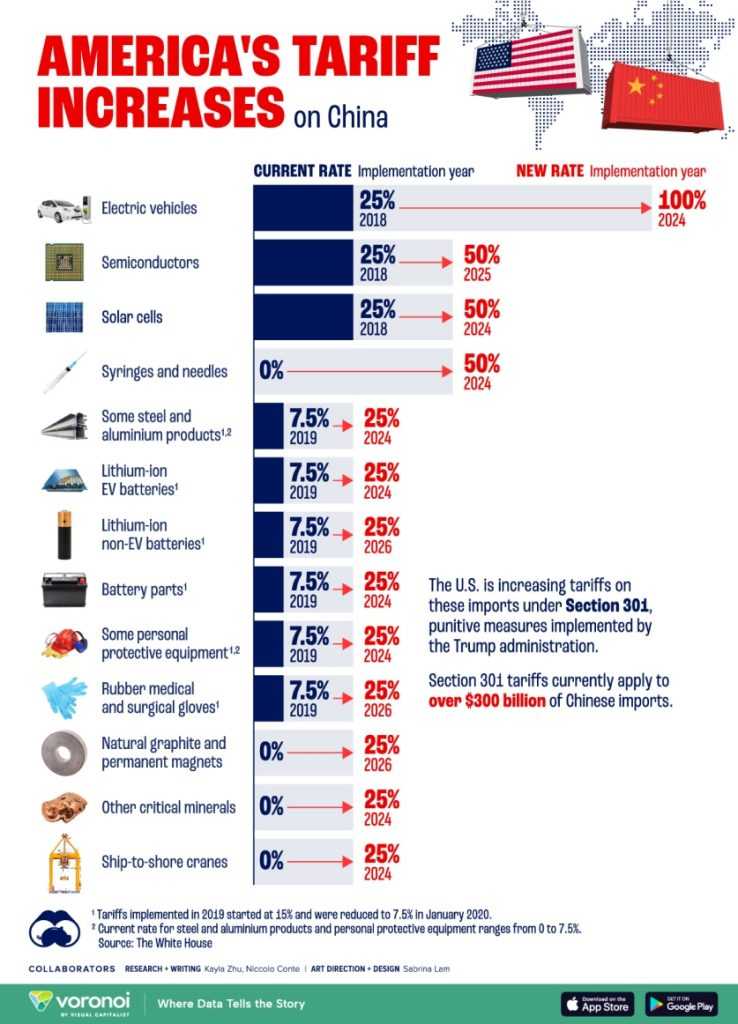

Tariff Increases on Chinese Imports

Source: Visual Capitalist

Global Mining Landscape Shifts

The increased costs in the U.S. may lead to a redistribution of mining activities globally. Countries with lower operational costs and fewer trade restrictions could become more attractive for mining operations. This shift could diminish the U.S.’s dominance in the Bitcoin mining sector.

Jaran Mellerud, CEO of Hashlabs Mining, noted that the tariffs could paradoxically benefit miners outside the U.S. by reducing competition and potentially lowering equipment prices in other regions.

Adaptation and Resilience

Despite the challenges, some U.S. mining companies are exploring ways to adapt. This includes seeking alternative suppliers, investing in domestic manufacturing, and optimizing existing operations to maintain profitability.

Zach Bradford, CEO of CleanSpark, expressed confidence in their ability to navigate the new landscape, emphasizing the importance of resilience and strategic planning in the face of economic uncertainties.

Conclusion

China’s retaliatory tariffs have introduced significant challenges for the U.S. Bitcoin mining industry, increasing operational costs and potentially altering the global mining landscape. While the immediate impact is substantial, the industry’s response and adaptability will determine its long-term resilience and position in the global market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Alma Sarah is a freelance writer and marketing consultant. Alma specializes in content marketing, SEM, SEO and social media strategy. When she’s not writing, Alma enjoys hanging out with friends, cooking, and spending time with her family.