A Deep Dive into Bybit’s Trading Features, Strengths, Limitations, and Why It Remains a Top Choice for Crypto Derivatives in 2025

Bybit is a cryptocurrency derivatives exchange established in 2018, recognized for its robust leveraged trading capabilities. It quickly rose in popularity due to its offerings in options and futures trading. The platform features an intuitive interface, advanced trading tools, and competitive fees. With support for over 1,200 cryptocurrencies, including major assets like Bitcoin and Ethereum, Bybit provides a secure and efficient environment for traders.

The exchange is known for its user-friendly design and high liquidity. It supports various trading options, including leverage trading, perpetual contracts, and spot trading, catering to diverse trading strategies and risk preferences. Bybit’s customer support team is responsive, and the platform frequently hosts events that offer rewards and bonuses. It also provides advanced tools to help users manage their activities and mitigate trading risks effectively.

Despite its strengths, Bybit has a few limitations. It does not allow trading with fiat currencies and is not accessible in all regions, including the United States.

This review offers a detailed look into Bybit’s features, outlining its advantages and drawbacks. It covers the platform’s safety, regulatory considerations, and trading functionalities.

Bybit Exchange Review: Overview

Bybit is a trusted cryptocurrency derivatives exchange that allows users to trade Bitcoin and over 1,200 other digital assets. Known for its beginner-friendly interface, the platform also delivers powerful tools suited to advanced traders. Its ultra-fast matching engine ensures smooth and rapid order execution, contributing to a seamless trading experience.

The exchange offers futures trading with leverage up to 125x, alongside other features like margin trading, copy trading, trading bots, staking services, and options trading. To ensure fund safety, Bybit employs robust security protocols including cold wallet storage, two-factor authentication (2FA), multi-signature wallets, and an insurance fund. Customer support is available 24/7.

Quick Facts

- Best For: Derivatives trading

- Supported Coins: 1,200+ trading pairs

- Trading Fees: 0.1% maker / taker

- Maximum Leverage: Up to 125x on futures

- Security Measures: 2FA, cold storage, multi-sig wallets, insurance fund

- Fiat Support: USD, EUR, GBP, and 20+ additional currencies

- Payment Methods: Bank transfer, credit/debit cards, crypto transfers, and third-party fiat on/off-ramps

Key Pros

- High-speed trading engine with zero price slippage

- Competitive fee structure

- Advanced trading tools and automation features

- Intuitive mobile app for Android and iOS

- Strong security, including Proof of Reserves (PoR) transparency

Key Cons

- Not available for users in the United States

- Limited regulatory oversight in some jurisdictions

Quick Summary: Bybit Exchange Overview

| Key Point | Information |

| Founded | 2018 |

| Founder | Ben Zhou |

| Headquarters | Dubai |

| Platform Type | Cryptocurrency Exchange |

| Main Services | Futures, Margin, Spot, Copy Trading, Options, P2P, Staking, Trading Bots, Launchpad |

| Supported Cryptos | Bitcoin, Ethereum, XRP, EOS, and 1,200+ others |

| Trading Pairs | 1,200+ |

| Fiat Support | Yes |

| Leverage | Up to 125x |

| Security Features | Cold Wallet Storage, 2FA, SSL, Insurance Fund, Anti-Phishing, Withdrawal Whitelist |

| Mobile App | Yes (iOS and Android) |

| Fee Structure | 0.1% (Spot Market); 0.02% Maker / 0.055% Taker (Futures) |

| Customer Support | 24/7 Live Chat and Email |

| Educational Resources | Blog, Tutorials, Webinars |

| Regulatory Status | Regulated by Dubai VARA & Cyprus SEC |

| Restricted Countries | U.S., U.K., China, Hong Kong, Singapore, Canada, Iran, Cuba, North Korea |

Top Trading Features on Bybit

Bybit caters to diverse trading styles through a wide array of features. Here are the most notable:

- Unified Trading Account (UTA):

Trade Spot, Futures, and Options using a single account. Unrealized profits can be used as collateral for other positions, streamlining portfolio management. - Margin Trading:

Leverage up to 10x on select pairs, with both cross and isolated margin modes available for customized risk management. - Multiple Order Types:

Includes Market and Limit Orders, as well as advanced types like iceberg, Take Profit/Stop Loss (TP/SL), and scaled orders. - Advanced Charting Tools:

Integrated with TradingView, offering real-time charts, technical indicators, and drawing tools for precision analysis. - Flexible Fiat Deposit Options:

Purchase crypto via bank transfers, credit/debit cards, P2P, and third-party processors such as MoonPay, Banxa, and Simplex. - Trading Bots:

Automated trading tools for both Spot and Futures markets. Options include Grid Bots (ideal for range trading) and DCA Bots (for automated crypto accumulation). - Copy Trading:

Beginners can mirror the trades of experienced investors in real time, gaining exposure to strategic decisions without manual effort. - Crypto Staking:

Stake digital assets to earn interest—APYs can reach up to 30%, depending on the token and market conditions. - Launchpad Access:

Participate in early-stage crypto project launches and gain early exposure to promising tokens before they’re widely listed.

Bybit’s Web3 Ecosystem

- Bybit NFT Marketplace:

Discover, buy, sell, and trade NFTs directly within the platform. Explore collections including digital art, collectibles, GameFi items, and metaverse assets. - Bybit Wallet:

Your all-in-one Web3 gateway. Easily connect to DeFi platforms, NFT marketplaces, and interact with decentralized applications—all from a single interface.

Does Bybit Charge Trading Fees?

Yes, Bybit applies maker and taker fees across spot, futures, and options markets. The exact fee depends on the user’s VIP level. Below is a breakdown of the current fee structure:

| VIP Level | Spot Maker / Taker | Futures Maker / Taker | Options Maker / Taker |

| VIP 0 | 0.1000% / 0.1000% | 0.0200% / 0.0550% | 0.0200% / 0.0200% |

| VIP 1 | 0.0675% / 0.0800% | 0.0180% / 0.0400% | 0.0150% / 0.0200% |

| VIP 2 | 0.0650% / 0.0775% | 0.0160% / 0.0375% | 0.0150% / 0.0200% |

| VIP 3 | 0.0625% / 0.0750% | 0.0140% / 0.0350% | 0.0150% / 0.0200% |

| VIP 4 | 0.0500% / 0.0600% | 0.0120% / 0.0320% | 0.0150% / 0.0180% |

| VIP 5 | 0.0400% / 0.0500% | 0.0100% / 0.0320% | 0.0100% / 0.0150% |

| Supreme VIP | 0.0300% / 0.0450% | 0.0000% / 0.0300% | 0.0020% / 0.0150% |

Regular users (VIP 0) pay the following:

- Spot Trading: 0.1% maker / taker

- Futures Trading: 0.02% maker / 0.055% taker

- Options Trading: 0.02% maker / taker

Deposit and Withdrawal Fees

- Crypto Deposits: Free of charge. Users can transfer digital assets to their Bybit wallet without incurring any deposit fees.

- Fiat Deposits: May incur third-party fees, especially when using credit/debit cards or payment processors—up to 3% per transaction.

- Withdrawals: Subject to a fixed fee depending on the cryptocurrency and network used. These fees are automatically deducted and help ensure fast confirmation on the blockchain. Internal transfers between Bybit users are free.

| Asset | Network | Minimum Withdrawal | Withdrawal Fee |

| BTC | Bitcoin | 0.001 BTC | 0.0005 BTC |

| ETH | ERC-20 | 0.02 ETH | 0.01 ETH |

| XRP | XRP Ledger | 20 XRP | 0.25 XRP |

| USDT | ERC-20 | 10 USDT | 10 USDT |

Read the full Bybit fee structure here.

Is Bybit a Safe Exchange to Use?

Yes, Bybit implements multiple layers of security to protect user funds and data. The majority of crypto assets are stored in offline cold wallets, with only a small amount retained in hot wallets to meet withdrawal demands.

Key Security Features:

- Multi-Signature Wallets: Transactions from cold storage require multiple approvals, preventing unilateral access.

- SSL Encryption: The Bybit website is secured via SSL, protecting users from phishing and man-in-the-middle attacks. Always check for the lock icon and “https://” in the URL.

- 2FA Authentication: Adds an extra layer of login security for all users.

- Anti-Phishing Code: Custom code shown in Bybit emails to verify authenticity.

- Withdrawal Address Whitelisting: Only pre-approved wallet addresses can receive withdrawals.

- Fund Passwords & Withdrawal Locks: Optional security settings to restrict access and transactions.

Authenticity Checker: Verifies the legitimacy of Bybit domains and URLs.

Security Ratings & Audits:

An independent audit by Certified ranked Bybit as a Top 10 Secure Crypto Exchange, awarding it an AAA security rating—the highest possible.

Insurance Fund for Liquidation Protection

To minimize loss during extreme volatility, Bybit uses an insurance fund. This fund activates when a position is liquidated below its bankruptcy price, ensuring that traders don’t lose more than their initial margin.

Does Bybit Require KYC? What Are the Withdrawal Limits?

Bybit implements Know Your Customer (KYC) procedures with tiered verification levels that determine your daily and monthly withdrawal limits. While users can access certain features without KYC, higher limits and access to all services require identity verification.

Withdrawal Limits by KYC Level

| Verification Level | Requirements | Withdrawal Limits |

| KYC 0 (Unverified) | Email address only | Daily: ≤ 20,000 USDTMonthly: ≤ 100,000 USDT |

| KYC 1 | Government-issued ID, country of issuance, document photo, and selfie scan | Daily: ≤ 1,000,000 USDT |

| KYC 2 | Proof of address (utility bill, bank statement, etc.) | Daily: ≤ 2,000,000 USDT |

VIP Tier Withdrawal Limits

VIP users enjoy significantly higher limits:

- VIP 1: Up to 6,000,000 USDT daily

- VIP 5: Up to 10,000,000 USDT daily

- Supreme VIP: Up to 12,000,000 USDT daily

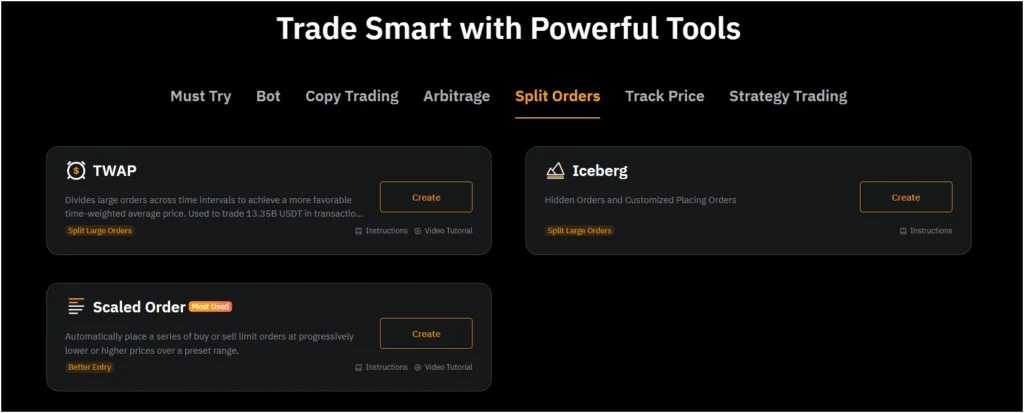

Advanced Order Types on Bybit

Bybit offers a sophisticated set of order types designed to meet the needs of both professional traders and active retail users. These tools help automate strategy, manage risk, and execute trades with greater precision.

Key Order Types Explained

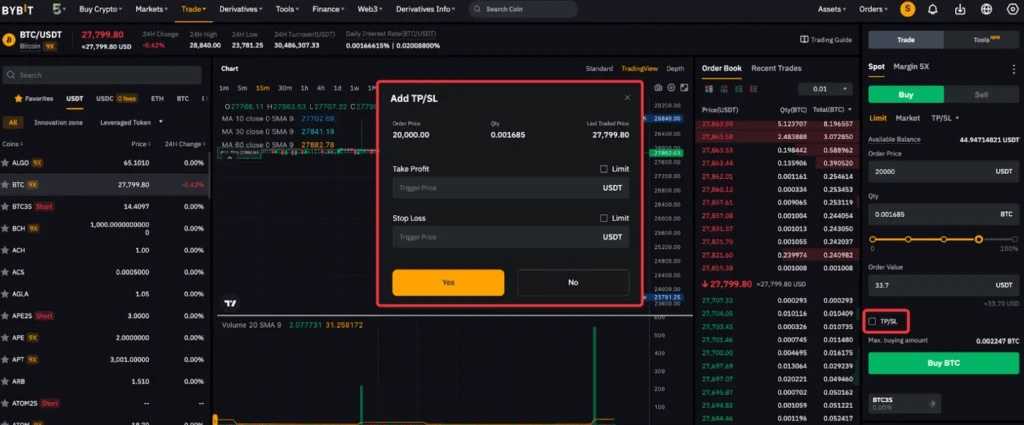

- Take Profit / Stop Loss:

Automates position closure at set profit or loss levels to lock in gains or limit exposure. - Iceberg Order:

Splits a large order into smaller visible portions, hiding the total size to reduce market impact and slippage. - Post-Only Order:

Ensures your order is added to the order book as a maker, avoiding taker fees and potentially earning maker rebates. - Time in Force (TIF):

- GTC (Good ‘Til Canceled): Remains active until manually canceled.

- IOC (Immediate or Cancel): Executes immediately; unfilled portions are canceled.

- FOK (Fill or Kill): Executes the entire order immediately or cancels it completely.

- GTC (Good ‘Til Canceled): Remains active until manually canceled.

- Trailing Stop Order:

Dynamically follows the market price, helping to secure profits while limiting losses based on a set percentage or value. - TWAP (Time-Weighted Average Price):

Executes a large trade over time to minimize market disruption, targeting an average market-reflective price. - OCO (One-Cancels-the-Other):

Links two conditional orders so that executing one automatically cancels the other—ideal for managing risk in volatile markets. - Reduce-Only Order:

Ensures the order only reduces an open position rather than increasing exposure. - Close on Trigger:

Automatically closes a position when a designated price level is reached, protecting against sudden moves. - Scaled Order:

Divides a large trade into smaller orders at different price points, enabling more strategic market entry or exit. - Chase Limit Order:

Adjusts the limit price automatically in response to market movements, improving the likelihood of execution without crossing the spread.

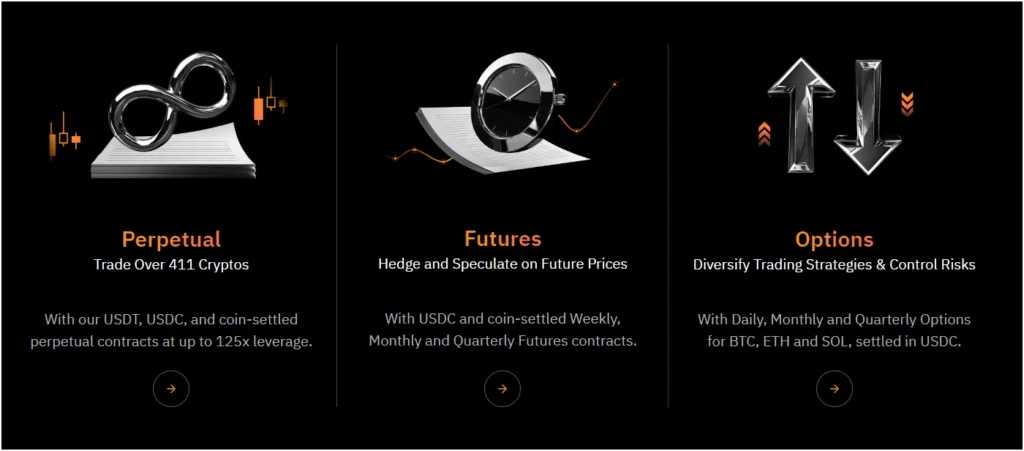

Derivatives Trading on Bybit

Bybit offers a comprehensive derivatives trading platform designed for both novice and professional traders. The core of this offering includes futures contracts and options trading, each with flexible margin options and high-leverage potential.

Types of Futures Contracts on Bybit

Bybit supports two primary futures contract types:

- Inverse Contracts:

These contracts are margined and settled in the underlying cryptocurrency. For example, when trading BTC/USD inverse contracts, your margin and any profit or loss are denominated in Bitcoin (BTC). This is suitable for users who prefer to maintain exposure to the asset being traded. - Linear Contracts:

Margined and settled in stablecoins like USDT or USDC, linear contracts are ideal for those looking to reduce exposure to crypto volatility. For instance, trading BTC/USDT means your gains and losses are in USDT, making it easier to manage and calculate your portfolio value.

Bybit supports leverage up to 125x on certain contracts such as BTC and ETH, enabling traders to control large positions with comparatively smaller capital.

Margin Modes Explained

To accommodate different risk appetites, Bybit offers two margin modes:

- Cross Margin Mode:

This mode pools your available account balance across all positions. If one position experiences a loss, it can tap into the remaining balance to avoid liquidation. It’s best suited for experienced traders managing multiple positions and comfortable with higher risk exposure. - Isolated Margin Mode:

Here, only a specific amount of margin is allocated to each trade. If the position is liquidated, only the assigned margin is lost, while the rest of the account remains unaffected. This mode is ideal for risk-conscious traders who prefer tighter control over individual trades.

Options Trading on Bybit

In addition to futures, Bybit offers options contracts, which provide strategic flexibility without the obligation to execute the trade.

- Call Options:

These give you the right (but not the obligation) to buy an asset at a predetermined price before the expiration date. - Put Options:

These give you the right to sell an asset at a set price within a specific time frame.

Options are valuable tools for hedging, speculation, and enhancing existing futures strategies, allowing users to manage both downside risk and upside potential more effectively.

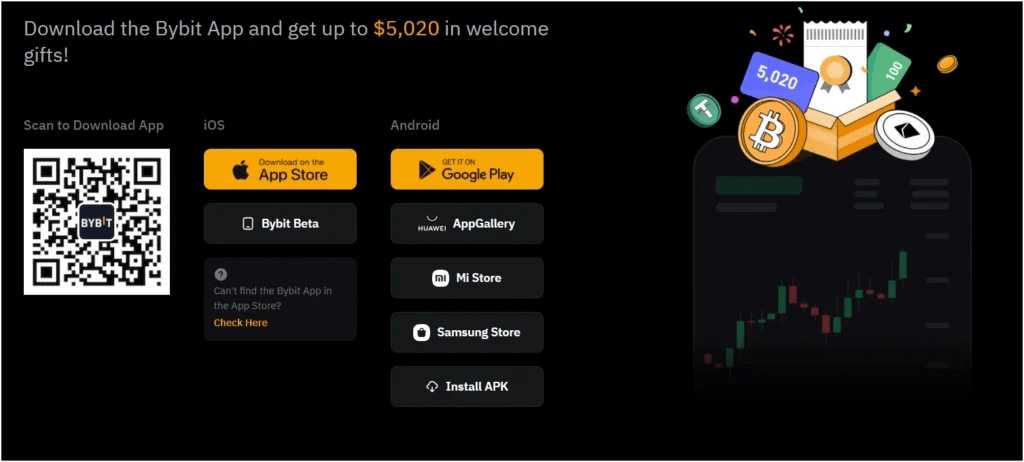

Bybit Mobile App & Customer Support

Bybit delivers a smooth and efficient mobile trading experience through its dedicated app, available for both iOS and Android devices. The app is designed with an intuitive interface, allowing users to easily buy, sell, and trade cryptocurrencies directly from their smartphones. It replicates the full functionality of the desktop platform, ensuring that users can manage their portfolios and execute trades without compromise, even while on the go.

One of the standout features of the Bybit mobile app is its integration of advanced charting tools. Traders can view and analyze price trends, apply technical indicators, and make informed decisions no matter where they are. The app also maintains the same level of security as the desktop version, including cold storage for digital assets and real-time risk monitoring. This consistency in security infrastructure ensures peace of mind for users, whether they’re at home or trading on the move.

Users can also access and manage deposits, withdrawals, and transfers directly from the app. The platform supports a customizable experience, including the option to display regional fiat currencies for better clarity. Additionally, the mobile app includes access to Bybit’s affiliate and referral programs, allowing users to earn rewards by inviting others to the platform—all from within the app itself.

Overall, the Bybit mobile app stands out as a robust, feature-rich solution for traders who demand flexibility without sacrificing functionality or security.

Bybit enjoys a strong reputation among its user base, boasting a customer rating of 4.6 out of 5 on the Google Play Store and 4.7 out of 5 on the Apple App Store. Traders frequently praise the platform for its clean and user-friendly interface, rapid trade execution, and robust set of tools tailored for experienced users. However, some users have noted occasional delays in customer support response times, which may affect the experience during urgent issues.

Customer support on Bybit is accessible through multiple channels. For general inquiries or platform navigation, the Help Center serves as a comprehensive resource filled with guides, tutorials, and FAQs. For more personalized assistance, users can submit a support ticket or use the live chat feature, which connects you to a representative for real-time help.

In cases involving deposit or withdrawal issues through third-party payment processors, Bybit recommends contacting the third-party provider directly. Contact information for these services is available on Bybit’s official website, ensuring users can reach the appropriate support team when external transactions are involved.

How to Buy Cryptocurrency on Bybit

To buy cryptocurrency on Bybit, the first step is to create an account by visiting the official Bybit website. You’ll need to sign up using your email address and set a strong, secure password. After registering, you’ll receive a verification email—click the link provided to confirm your email address. Once your account is verified, it’s important to complete the Know Your Customer (KYC) process by submitting the required identification documents. This step is essential to unlock full platform access and higher withdrawal limits.

After successfully logging in, it’s strongly recommended to enhance your account security by enabling Two-Factor Authentication (2FA). You can activate this feature by navigating to the “Account & Security” section of your dashboard. This added layer of protection helps ensure your funds and personal information remain safe.

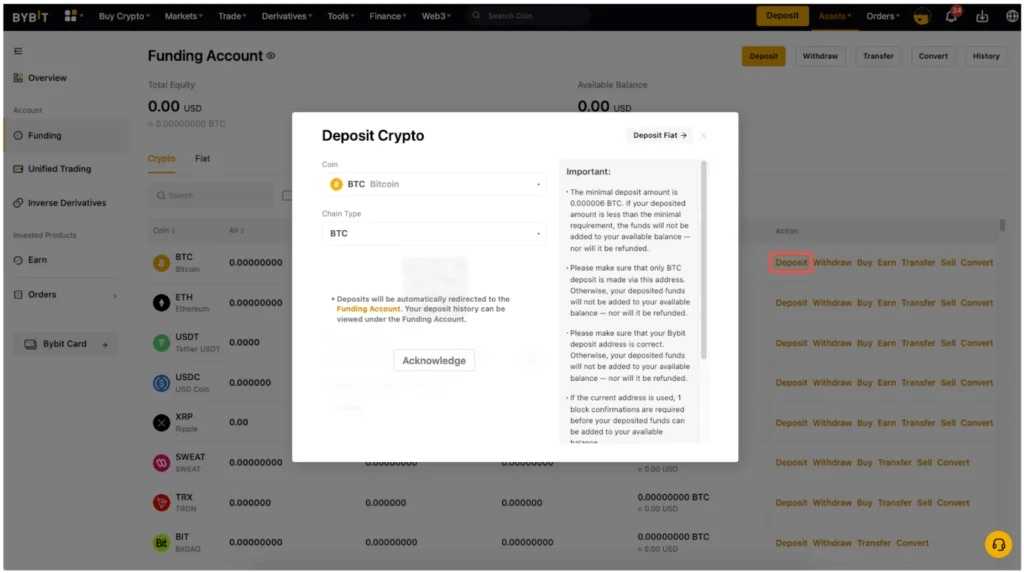

Step 2: Deposit Cryptocurrency into Your Bybit Account

Once your Bybit account is set up and verified, the next step is to deposit cryptocurrency into your wallet. Start by logging into your account and navigating to the “Assets” section on the platform. From there, click on “Deposit” and choose the cryptocurrency you want to transfer—such as Bitcoin (BTC) or Ethereum (ETH). You will be provided with a unique deposit address for the selected coin.

Copy this address carefully and use it to initiate a transfer from your external wallet or another exchange account. After the transaction is processed and confirmed on the blockchain, the funds will appear in your Bybit wallet. Be sure to double-check the address and transaction details to avoid any errors.

Step 3: Get Familiar with Bybit’s Trading Interface

After depositing funds, it’s important to explore the Bybit trading interface to understand how the platform works. Click on the “Trade” tab and select your preferred trading pair, such as BTC/USD. The interface includes essential components like the price chart, order book, recent trades panel, and order entry fields. Getting comfortable with this layout is key to executing informed and efficient trading decisions.

Step 4: Place and Manage Your Trading Orders

With a clear understanding of the interface, you can now begin trading. Choose from different order types such as Limit, Market, or Conditional. For Limit orders, enter the desired price and quantity manually. Market orders, on the other hand, execute instantly at the current market price. Once you’ve configured your order, click “Buy” or “Sell” to place it. To monitor or adjust your trades, head to the “Orders” tab where you can view, cancel, or modify your open positions as needed.

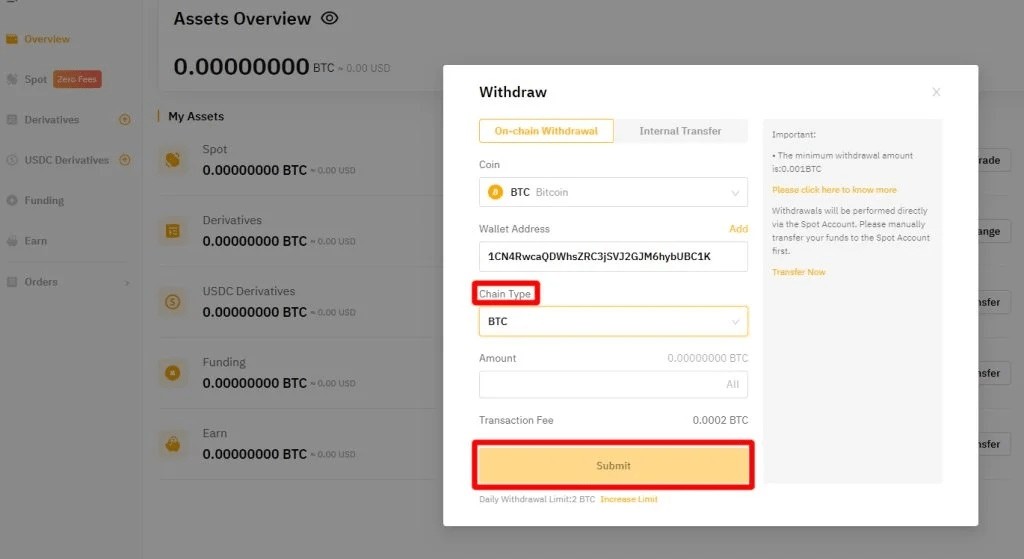

Step 5: Withdraw Your Funds from Bybit

When you’re ready to withdraw funds, go to the “Assets” section and click “Withdraw.” Select the cryptocurrency you want to transfer, enter the destination wallet address, and specify the amount. You’ll be prompted to confirm the transaction using Two-Factor Authentication (2FA). After submitting your request, monitor the status of the withdrawal until it successfully reflects in your external wallet.

Best Bybit Alternatives to Consider

If you’re exploring platforms beyond Bybit, Bitget and KuCoin are two strong alternatives.

Bitget is best known for its crypto copy trading features. It supports over 850 cryptocurrencies, including many low-cap altcoins, and offers both spot and futures trading with leverage up to 125x. Bitget also features automated trading bots and supports deposits through bank transfers, credit/debit cards, and a P2P marketplace.

KuCoin is ideal for discovering new and emerging altcoins. With support for over 700 cryptocurrencies, it offers spot, margin, and futures trading, as well as trading bots and P2P functionality. Deposit options include Visa, Mastercard, SEPA, UPI, Faster Payment System (FPS), and more than 70 other methods.

Final Verdict: Is Bybit Worth It?

Bybit stands out as a reliable and efficient platform for trading major cryptocurrencies like Bitcoin and Ethereum. Its clean, intuitive design makes it accessible to beginners, while its advanced tools and high-leverage options cater to experienced traders. One of its biggest strengths is the ability to engage in leverage trading, allowing users to amplify potential gains by borrowing capital. For instance, a trader can open a $1,000 position with just $100 by using 10x leverage.

However, leverage trading also introduces significant risks. A market drop of just 10% could wipe out the entire investment in a 10x leveraged position. This highlights the importance of risk management, especially for newer traders. Additionally, Bybit is not accessible in certain regions, including the United States, due to regulatory restrictions. Despite these limitations, Bybit remains a strong choice for users looking for a powerful and user-friendly cryptocurrency trading platform.

Disclaimer: This article is for informational purposes only. It is not financial advice. Always do your own research (DYOR) before investing in cryptocurrencies.

Since 2023, Yoshi Ae has combined storytelling and community insight as a PR writer, creating content that resonates across platforms like X and Discord. From press releases to narrative campaigns, Yoshi bridges brand messaging with real-time community engagement.