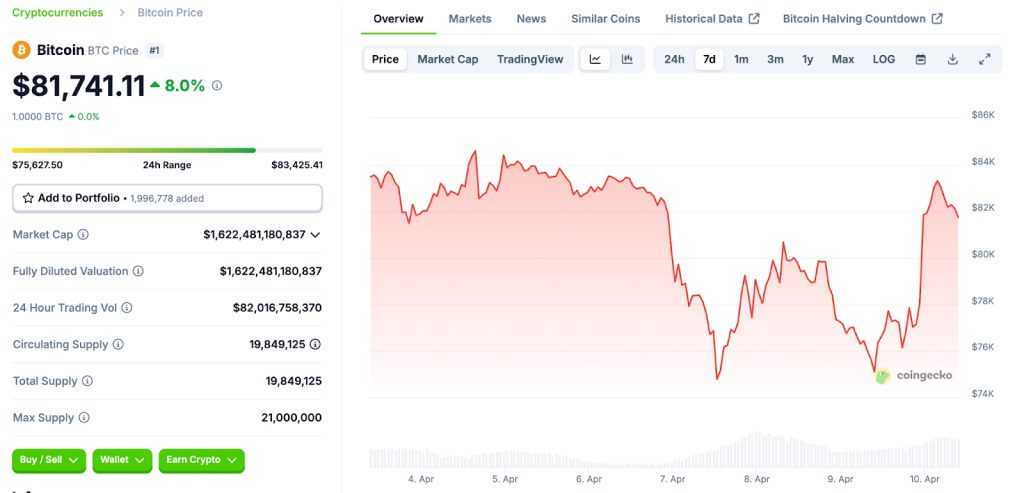

- Bitcoin’s Volatility Amid Trade Tensions: Bitcoin’s price has experienced significant fluctuations, dropping below $75,000 following President Trump’s tariff announcements.

- Tariff Announcements Impact Markets: The imposition of new tariffs by the U.S. and retaliatory measures by China have led to increased market volatility.

- Cryptocurrency Market Reacts: Major cryptocurrencies, including Bitcoin and XRP, have seen notable price declines in response to escalating trade tensions. Barron’s

- Investor Sentiment Shifts: The uncertainty surrounding international trade policies has influenced investor behavior, leading to a move away from riskier assets.

- Potential for Market Recovery: Analysts suggest that positive macroeconomic developments could bolster cryptocurrency prices despite current downturns.

In recent weeks, the cryptocurrency market has been on a tumultuous ride, with Bitcoin (BTC) at the forefront of this volatility. The digital currency’s price has oscillated dramatically, influenced by geopolitical events and economic policies. Notably, President Donald Trump’s tariff announcements have played a pivotal role in these market movements.

Source: Coingecko

On April 9, 2025, President Trump declared a 90-day pause on “reciprocal” tariffs, setting a base tariff of 10% on most countries, while maintaining a 125% tariff on Chinese goods due to prior retaliatory measures. This announcement led to a surge in risk assets, with Bitcoin’s price climbing from below $77,000 to approximately $83,000. Crypto-related stocks also experienced significant gains; for instance, MicroStrategy’s shares soared by nearly 25%, and Coinbase Global saw a 17% increase. Source: Investopedia

However, this surge was short-lived. The initial optimism was tempered by market realities, as the broader implications of the ongoing trade tensions became evident. Despite the temporary pause, the underlying issues between the U.S. and its trading partners, particularly China, remained unresolved. This uncertainty led to renewed market volatility, with Bitcoin’s price experiencing further fluctuations.

The cryptocurrency market’s sensitivity to geopolitical events underscores the interconnectedness of global economies and the impact of policy decisions on digital assets. While Bitcoin has often been touted as a “safe haven” asset, recent events highlight its vulnerability to external shocks.

Analysts remain divided on the future trajectory of Bitcoin’s price. Some believe that the current volatility presents a buying opportunity, anticipating a rebound as market conditions stabilize. Others caution that continued geopolitical tensions and potential regulatory changes could exert further downward pressure on prices.

In conclusion, the recent rollercoaster ride of Bitcoin’s price serves as a reminder of the cryptocurrency market’s inherent volatility. Investors should remain vigilant, stay informed about global economic developments, and consider their risk tolerance when navigating this dynamic landscape.

Note: This article reflects market conditions and forecasts as of April 10, 2025. Crypto markets are inherently volatile. Readers are encouraged to do their own research before making investment decisions.

Andrej is an experienced content and copywriter who’s been creating impactful, engaging content since 2022. Though he’s worked across various of industries, he specializes in Crypto, Web3, and SaaS. From in-depth blog posts to high-converting web copy, he combines strategic thinking with a natural flair for storytelling to deliver content that not only informs but also resonates with readers