Key Takeaways

- Michaël van de Poppe, a prominent crypto analyst, projects that Bitcoin (BTC) could ascend to $500,000 in the current market cycle, driven by institutional adoption and macroeconomic factors.

- Anthony Pompliano suggests that recent U.S. tariff implementations may lead to economic conditions favorable for Bitcoin’s growth.

In the dynamic realm of cryptocurrencies, Bitcoin’s future remains a focal point of analysis. Michaël van de Poppe, a respected crypto analyst, envisions a scenario where Bitcoin’s price could surge to $500,000 in the current market cycle. This optimistic projection is underpinned by the increasing institutional adoption of cryptocurrencies and significant macroeconomic shifts globally.

Van de Poppe emphasizes the importance of a long-term perspective, cautioning investors against making impulsive decisions based on short-term market fluctuations. He notes that emotional reactions during market downturns can lead to significant losses, advocating instead for patience and strategic planning.

Tariffs and Their Potential Impact on Bitcoin

The recent introduction of tariffs by the U.S. administration has sparked discussions about their broader economic implications. Anthony Pompliano, co-founder of Morgan Creek Digital, views these tariffs as potential catalysts for Bitcoin’s growth. He argues that such economic policies highlight the inefficiencies of traditional financial systems, thereby bolstering the case for decentralized finance solutions like Bitcoin.

Pompliano suggests that the current moment is pivotal for backing future winners in the Bitcoin and decentralized finance ecosystem. The introduction of tariffs is intended to address trade disparities and encourage domestic economic growth. The immediate reaction in the markets, particularly the gains in cryptocurrencies and stock futures, suggests optimism about future economic conditions among investors.

Global Economic Implications and Bitcoin

Conversely, Ray Dalio, founder of Bridgewater Associates, offers a more cautionary perspective. He warns that the newly unveiled tariff policies could lead to a surge in global stagflation—a combination of stagnant economic growth and rising inflation. Such a scenario could significantly reshape U.S.-China trade relations and destabilize the global monetary system, leading to increased market volatility.

Dalio’s analysis suggests that while tariffs may reduce efficiency by limiting global supply access, they enhance domestic resilience. However, the long-term stability of markets will depend on trust in debt quality, national productivity, and sound political systems. For Bitcoin, this could mean heightened price swings as investors navigate the uncertainties of a shifting economic landscape.

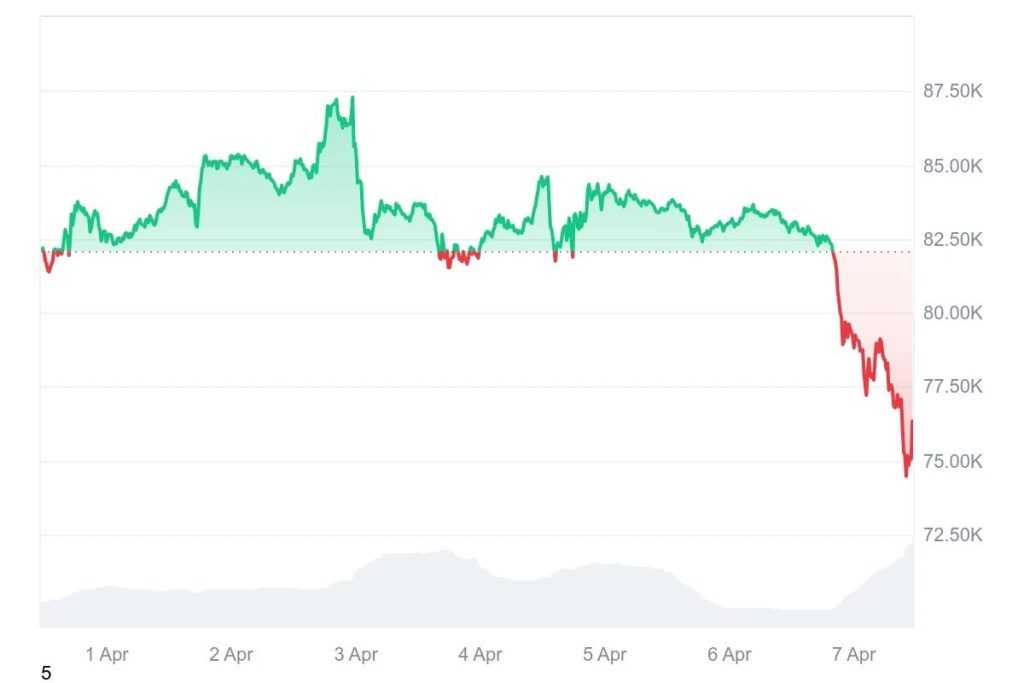

Source: CoinMarketCap

Market Sentiment and Bitcoin’s Current Position

Amid these macroeconomic discussions, the cryptocurrency market is experiencing notable turbulence. Bitcoin’s price has seen fluctuations, mirroring corrections in traditional stock markets. Altcoins have faced even steeper declines, with many registering double-digit losses. Analysts suggest that Bitcoin may be in a phase of bottoming out, potentially setting the stage for future price movements.

Bottom Line

Bitcoin stands at a crossroads, with its future price trajectory heavily influenced by forthcoming monetary policies and global economic developments. While expansive monetary measures and increasing institutional adoption could propel Bitcoin to unprecedented highs, factors like escalating tariffs and potential stagflation pose significant risks. Investors are advised to remain vigilant, adopt a long-term perspective, and stay informed about macroeconomic indicators that could impact the cryptocurrency market.

Disclaimer: This article is for informational purposes only. It is not financial advice. Always do your own research (DYOR) before investing in cryptocurrencies.

Filip is a copywriter for startups and B2B SaaS. He’s also been working as a marketer for a variety of crypto projects since 2020.