Key Takeaways

- U.S. spot Bitcoin ETFs recorded a cumulative net inflow of $802.5 million over four days, with BlackRock’s IBIT leading at $661.9 million.

- The surge in inflows coincided with renewed bullish sentiment in the Bitcoin options market, indicating strong investor confidence.

- Analysts suggest that continued institutional interest could propel Bitcoin to new all-time highs in the near future.

Introduction

In a remarkable display of investor confidence, U.S.-listed spot Bitcoin exchange-traded funds (ETFs) have amassed a staggering $802.5 million in net inflows over a four-day period. This influx of capital underscores the growing institutional appetite for Bitcoin and signals a potential shift in the cryptocurrency’s market dynamics.

ETF Inflows Surge

Smaller contributions came from ARK 21Shares’ ARKB, Fidelity’s FBTC, and Franklin Templeton’s EZBC, each recording modest inflows. In contrast, Bitwise’s BITB reported an outflow of $17.41 million, standing apart from the broader positive trend.

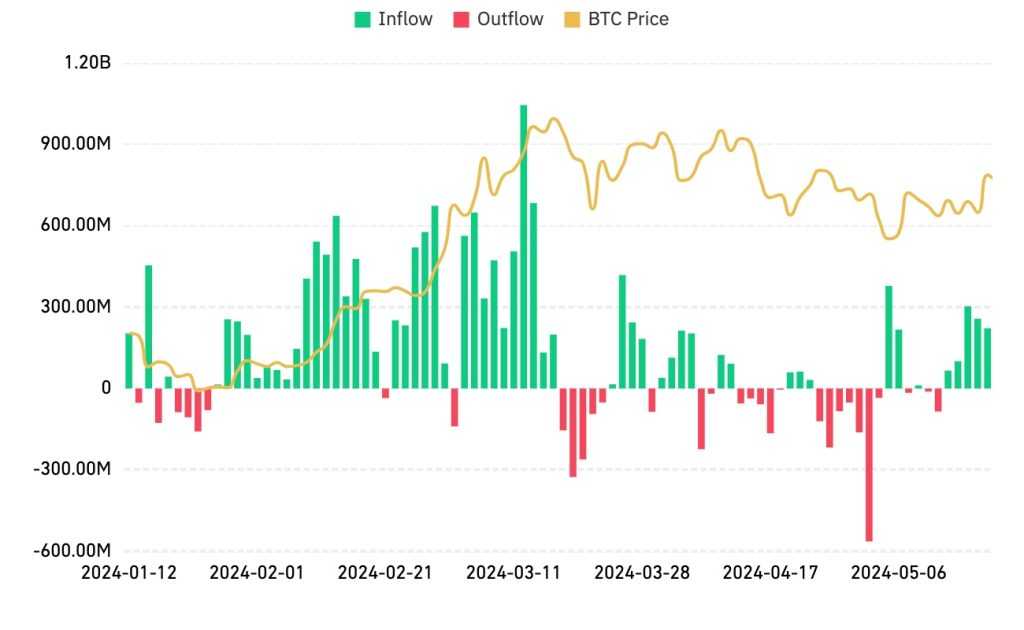

Bitcoin ETF Inflows

Source: CryptoNews

Market Implications

The substantial inflows into Bitcoin ETFs have coincided with a resurgence in bullish sentiment within the Bitcoin options market. Data from the Chicago Mercantile Exchange (CME) indicates that options traders are actively positioning for upside exposure, reflecting strong confidence in Bitcoin’s price trajectory.

Analysts suggest that the continued accumulation of Bitcoin by institutional investors through ETFs could serve as a catalyst for the cryptocurrency to reach new all-time highs. The combination of increased demand and reduced selling pressure from long-term holders creates a favorable environment for price appreciation.

Conclusion

The recent surge in Bitcoin ETF inflows highlights the growing institutional interest in the cryptocurrency and reinforces its position as a mainstream investment asset. As ETFs continue to attract substantial capital, Bitcoin’s market dynamics are poised for significant evolution, potentially leading to unprecedented price levels in the near future.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Andrej is an experienced content and copywriter who’s been creating impactful, engaging content since 2022. Though he’s worked across various of industries, he specializes in Crypto, Web3, and SaaS. From in-depth blog posts to high-converting web copy, he combines strategic thinking with a natural flair for storytelling to deliver content that not only informs but also resonates with readers