Key Takeaways

- Analysts Predict Surge: Experts forecast Bitcoin could reach $150,000 by 2025, mirroring its 360% surge in 2017.

- Institutional Adoption: Increased interest from institutional investors and the introduction of Bitcoin ETFs are significant drivers.

- Regulatory Environment: A favorable U.S. regulatory stance under the Trump administration is bolstering market confidence.

- Technical Patterns: Chart patterns, such as the “cup and handle,” suggest potential for substantial price increases.

- Market Sentiment: Despite recent volatility, the overall sentiment remains bullish, with expectations of continued growth.

Bitcoin’s Bullish Trajectory Towards $150K

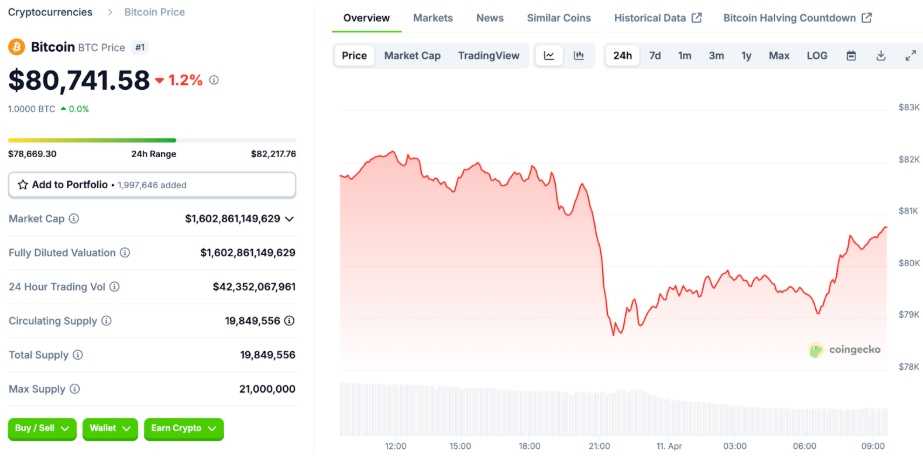

Bitcoin’s current consolidation around $80,000 has not dampened the optimism among analysts. Drawing parallels to the 2017 bull run, where Bitcoin experienced a 360% increase, experts believe a similar trajectory is plausible. Factors such as institutional adoption, favorable regulatory developments, and technical indicators support this bullish outlook.

Institutional Interest and ETF Inflows

The launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January has been a game-changer, attracting significant institutional investment. By the end of 2024, these ETFs held over 1 million Bitcoin, accounting for approximately 5% of the circulating supply. This institutional participation is expected to continue driving demand and price appreciation. FXStreet

Regulatory Tailwinds Under the Trump Administration

The re-election of President Donald Trump has introduced a more crypto-friendly regulatory environment in the U.S. Proposals such as the creation of a national strategic Bitcoin reserve and reduced regulatory scrutiny have bolstered market confidence. These developments are anticipated to further legitimize and integrate cryptocurrencies into the financial system.

Technical Indicators Signal Potential Breakout

Technical analysts highlight the formation of a “cup and handle” pattern in Bitcoin’s price chart, a bullish indicator suggesting a potential breakout. This pattern, coupled with other technical signals, reinforces the expectation of significant price increases in the near future.

Related Article: https://tokenfest.io/100k-btc-shocking-counter-trend-rally-forecast-has-traders-buzzing/

Expert Opinions on Bitcoin’s Future

Prominent figures in the crypto space, including analysts from Bernstein and Coin Bureau CEO Nic Puckrin, have expressed strong confidence in Bitcoin’s upward trajectory. They cite factors such as ETF inflows, institutional adoption, and favorable macroeconomic conditions as key drivers for potential price targets of $150,000 and beyond.

Global Adoption and Market Dynamics

The global landscape for Bitcoin is evolving rapidly, with increased adoption by corporations and governments. This widespread acceptance is contributing to the growing demand and scarcity of Bitcoin, further supporting bullish price predictions. FXStreet

Conclusion

While market volatility and external factors can influence short-term price movements, the overarching trend for Bitcoin remains positive. Analysts and experts alike foresee a strong potential for Bitcoin to reach $150,000 by 2025, driven by institutional adoption, favorable regulations, and robust technical indicators. As always, investors should conduct their own research and consider their risk tolerance when making investment decisions.

Note: This article reflects market conditions and forecasts as of April 11, 2025. Crypto markets are inherently volatile. Readers are encouraged to do their own research before making investment decisions.

Filip is a copywriter for startups and B2B SaaS. He’s also been working as a marketer for a variety of crypto projects since 2020.