Leverage trading has become a powerful tool for traders looking to amplify their profits in financial markets. Whether you’re trading cryptocurrencies, forex, stocks, or commodities, leverage can significantly increase your exposure without requiring the full amount of capital upfront. But with high potential rewards comes high risk.

If you’re new to leverage trading, this guide covers the essentials you need to know before getting started.

What Is Leverage Trading?

Leverage trading involves borrowing funds to increase the size of a trade. It allows traders to open positions larger than their actual account balance. For example, with 10x leverage, a trader with $100 can open a position worth $1,000.

Leverage is typically expressed as a ratio, such as 2x, 5x, 10x, or even higher, depending on the platform and asset. Higher leverage means higher potential profits — but also greater risk of losses.

How It Works

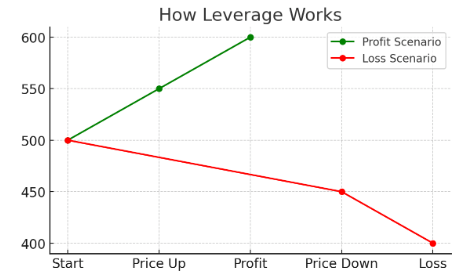

When you open a leveraged position, you’re effectively using borrowed capital provided by the trading platform or broker. You’ll be required to maintain a minimum balance, known as the margin, to keep the position open.

If the trade moves in your favor, your gains are magnified. If it goes against you, you risk a margin call or liquidation, where the platform closes your position to prevent further losses.

Example of Leverage in Action

- You have $500 in your trading account

- You open a 5x leveraged trade on Bitcoin

- Your total position size becomes $2,500

If Bitcoin rises 10%, your $2,500 position gains $250 (10%), giving you a $250 profit — a 50% gain on your original $500. However, if Bitcoin falls 10%, your loss is also $250, cutting your capital by half.

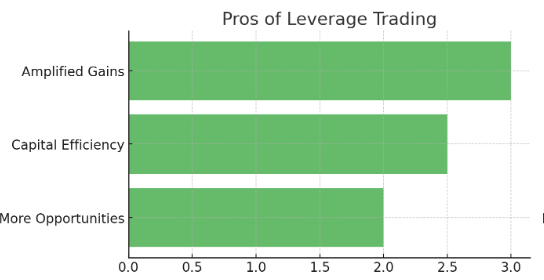

Pros of Leverage Trading

- Amplified Gains: Small price movements can result in substantial profits.

- Capital Efficiency: Use less capital to control larger positions.

- More Market Opportunities: Participate in more trades without needing full capital for each.

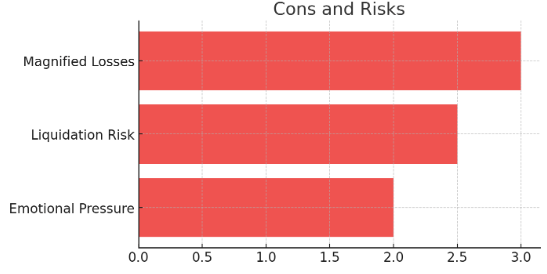

Cons and Risks

- Magnified Losses: Just as profits can grow quickly, so can losses.

- Liquidation Risk: You can lose your entire margin if the market moves against you.

- Emotional Pressure: High-stakes trading can lead to impulsive decisions and stress.

Risk Management Tips

- Start with Low Leverage: Beginners should stick to lower ratios like 2x or 3x.

- Use Stop-Loss Orders: Set automatic limits to protect your capital.

- Only Trade What You Can Afford to Lose: Never risk money you can’t afford to lose.

- Stay Informed: Always monitor your positions and stay updated with market news.

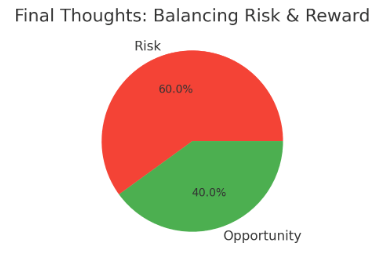

Final Thoughts

Leverage trading can be a powerful tool in your trading strategy, but it requires caution, discipline, and a strong understanding of the markets. While it offers the potential for increased gains, the risks are equally high.

By starting small, practicing sound risk management, and gradually increasing your exposure as your skills grow, you can use leverage to enhance your trading — without putting your entire portfolio at risk.

Always do your own research and consider practicing with demo accounts before trading with real funds.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Filip is a copywriter for startups and B2B SaaS. He’s also been working as a marketer for a variety of crypto projects since 2020.