Key Takeaways

- Bitcoin dips at $75K while bullish macro and institutional signals are on the rise.

- The market estimates $300K as the possible top in the 2025 cycle, much sooner than anticipated.

- ETF spot inflows, the halving event, and AI-driven demand indicate powerful market support.

- A positive shift in market outlook brings retail investors back into crypto.

- Long-term holders and smart money are not selling, but rather increasing their positions.

- Will we reach $300K and consider it the next stop, not the top?

Bitcoin’s 2025 Rally Is Not a Drill

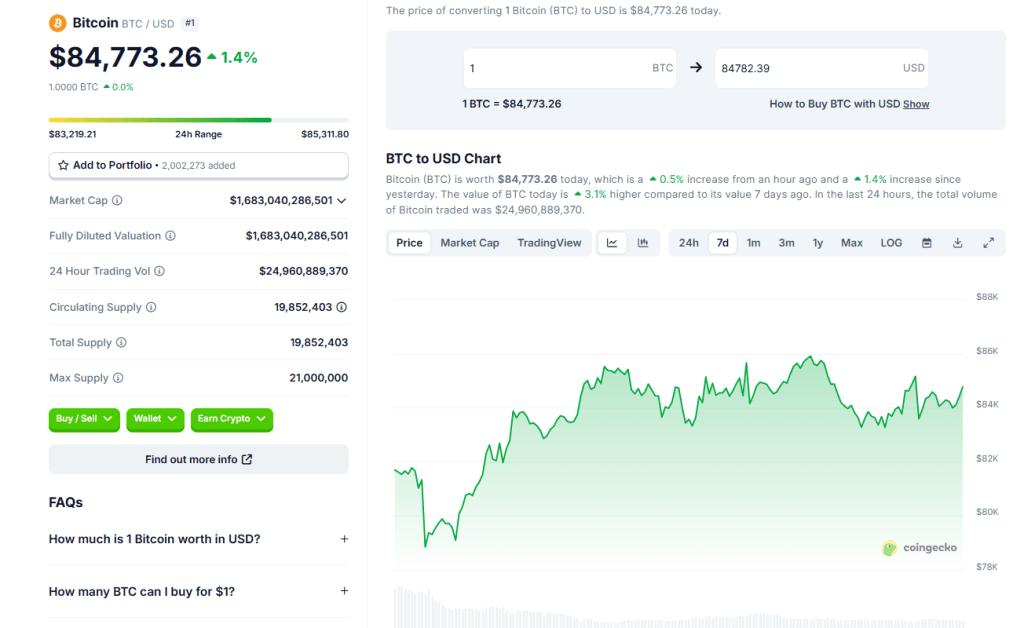

The largest digital asset, Bitcoin, has once again surpassed the $75,000 mark following its most recent surge. This has attracted the attention of both institutional giants and retail traders. While most people predicted a cool-off period after the digital asset’s halving, it seems Bitcoin might actually be gearing up for something larger. 300,000 doesn’t seem too far out of reach for the next breakout.

Now, what was once ridiculed as outlandish is now being suggested by reputable analysts. Prominent firms like CryptoQuant, alongside Bitwise CIO, Matt Hougan, and even well-known on-chain analysts, have set their expectations for this decalcation range between 250k to 350k. The true explosive analysis? The prediction is it might occur much earlier than expected.

Institutional FOMO is Fueling the Fire

Ever since the January approval of spot Bitcoin ETFs in the U.S., there has been a net inflow exceeding $12 billion — an indication of legitimacy that crypto advocates have been hoping for a decade. As CoinTelegraph put it, this ETF demand is not merely ephemeral; it is intensifying.

BlackRock’s IBIT alone has over $17 billion in assets under management. Recent filings indicate that other traditional finance players may also be launching Bitcoin-centric funds. In short: The street is interested.

“This is the largest transfer of wealth from TradFi to crypto we’ve seen yet.” — Matt Hougan, Bitwise CIO

Bitcoin’s Post-ETF Performance

The Bitcoin Halving Multiplier Effect

The Bitcoin halving occurred just days ago, slashing the miner reward from 6.25 Just a few days back, Bitcoin went through its halving event, reducing the reward for miners from 6.25 BTC to 3.125 BT. This event has historically launched bull runs for Bitcoin. But this time, it is colliding with:

- Global inflation which is revening interest in hard asssets

- Central banks from Asia and LATAM diversifying into Bitcoin

- AI trading bots providing liquidity to the BTC markets

This is best described by Glassnode as a ‘triple top ignition zone’. What does that mean? Buckle your seatbelt.

Retail Is Back, and They’re More Sophisticated

Retail Is Back, and They’re More Sophisticated

During Bitcoin’s rise from $30K to $70K, retail investors were mostly absent. That’s now transforming.

Since March, Coinbase, Binance, and Kraken have all experienced a 30-50% increase in new user signups. Remarkably, this cohort is educated and utilizing AI signals, on-chain metrics, and even diversification strategies throughout DeFi and layer-2s.

Even influencers on TikTok and YouTube focus on long-term HODLing rather than just pump-and-dump memes. The narrative is changing, and so are the flows.

Smart Money Is Sitting Tight

According to on-chain data from Glassnode and IntoTheBlock, over 72% of Bitcoin supply that hasn’t moved in 6 + months indicates unwavering conviction from long-term holders (LTHs).

Simultaneously, exchanges are catching sight of record-low BTC reserves, hinting that whales are shifting coins to cold wallets instead of preps for sell-offs.

These indicators have almost always been the signs of dramatic bull market growth.

Could $300K Be the Next Stop?

around $20K in 2017 and $100K in 2021. This time, however, there’s a clear trifecta:

- Fundamentals class inflow of institutional capital via ETFs

- Post-halving supply shock

- Acceleration of AI trading and adoption

Even if BTC does not hit 300K by 2025, the reward to risk ratio for accumulation at these levels is still favorable. We are witnessing the beginnings of a new era in crypto monetization.

Final Thoughts: Don’t Sleep on This Cycle

Bitcoin is more stronger than ever. This isn’t a flash in the pan surge, it is structurally, fundamentally, and psychologically more resilient now.

You may be watching the train leave the station if you are waiting for another market pullback. Adoption will no longer resemble 2017 or 2021, and the next phase will be fueled by AI, institutional entities, and completely unstoppable.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Mihajlo Tošić is a content writer specializing in iGaming, crypto, and Web3. He focuses on clear, direct writing that helps brands explain, sell, or promote what they do — without overcomplicating things.