Key Takeaways

- The Hong Kong Securities and Futures Commission (SFC) has approved the Bosera HashKey Ether ETF to engage in Ethereum staking, marking a first in the Asia-Pacific region.

- Up to 30% of the ETF’s holdings can be staked, with rewards reinvested to enhance investor returns.

- HashKey Cloud will provide secure and compliant staking services through its ETF Staking Pro platform.

- This development underscores Hong Kong’s commitment to becoming a leading hub for regulated virtual asset innovation.

Introduction

In a groundbreaking move, the Hong Kong Securities and Futures Commission (SFC) has granted approval for the Bosera HashKey Ether ETF to participate in Ethereum staking activities starting April 25, 2025. This marks the first time a virtual asset spot ETF in the Asia-Pacific region has been authorized to engage in staking, offering investors a novel avenue to earn rewards through a regulated investment vehicle.

Enhancing Investor Returns Through Staking

The approved staking mechanism allows the ETF to allocate up to 30% of its Ether holdings to staking activities. The rewards generated from staking will be reinvested into the ETF after deducting applicable service fees, aiming to boost the fund’s compound growth potential. This transition transforms the ETF from a passive investment tool into a dynamic vehicle that actively contributes to the Ethereum network while delivering added value to investors.

Secure and Compliant Staking Infrastructure

HashKey Cloud will oversee the staking operations through its ETF Staking Pro platform, ensuring a secure and compliant environment for the ETF’s assets. The platform is backed by a robust custody framework, comprehensive compliance structures, and stringent risk management measures, providing investors with confidence in the safety and integrity of their investments.

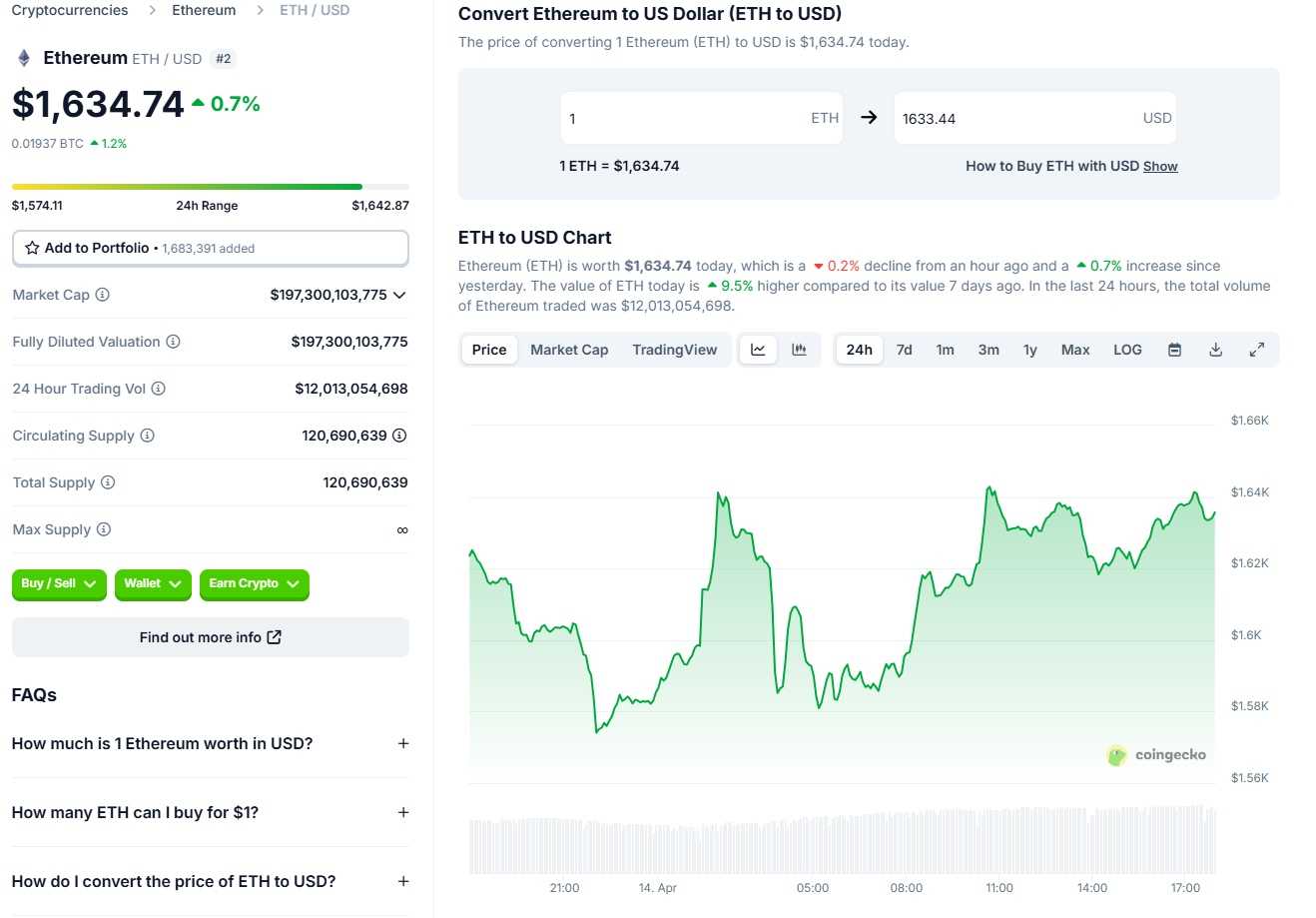

Ethereum Price Trend Supports ETF Staking Momentum

Source: Coingecko

The infographic illustrates the process of integrating Ethereum staking within an ETF structure, highlighting the flow of assets, staking rewards, and reinvestment strategies aimed at enhancing investor returns.

Industry Perspectives

Lian Shaodong, Chairwoman and CEO of Bosera International, emphasized the significance of the approval, stating, “Receiving approval to participate in staking marks a significant milestone in our ongoing commitment to Bosera’s investment philosophy and our continued exploration of opportunities in the virtual asset space.”

Deng Chao, CEO of HashKey Capital, highlighted the broader implications, noting that the ETF “significantly lowers the barrier to entry for investors, paving the way for broader participation in Ethereum staking and laying a strong foundation for deeper engagement with the Ethereum ecosystem and DeFi.”

Implications for Hong Kong’s Virtual Asset Landscape

This development reinforces Hong Kong’s position as a forward-thinking jurisdiction in the virtual asset space. By facilitating regulated Ethereum staking within an ETF framework, the region is setting a precedent for innovative financial products that bridge traditional finance and decentralized technologies. The move is expected to attract both institutional and retail investors seeking compliant exposure to the growing Ethereum ecosystem.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Andrej is an experienced content and copywriter who’s been creating impactful, engaging content since 2022. Though he’s worked across various of industries, he specializes in Crypto, Web3, and SaaS. From in-depth blog posts to high-converting web copy, he combines strategic thinking with a natural flair for storytelling to deliver content that not only informs but also resonates with readers