Key Takeaways

- Representative Maxine Waters has raised concerns over President Trump’s involvement in cryptocurrency ventures, citing potential conflicts of interest.

- The Trump family’s crypto firm, World Liberty Financial (WLFI), has reportedly generated significant revenue, leading to scrutiny from lawmakers.

- A joint letter from Waters and Senator Elizabeth Warren has been sent to the SEC, demanding transparency regarding WLFI’s operations.

Introduction

In recent months, President Donald Trump’s foray into the cryptocurrency space has garnered significant attention. At the center of this controversy is World Liberty Financial (WLFI), a crypto firm closely associated with the Trump family. The firm’s activities have prompted concerns from lawmakers, particularly Representative Maxine Waters, who has been vocal about potential conflicts of interest and the need for regulatory oversight.

The Emergence of World Liberty Financial

World Liberty Financial was launched as a cryptocurrency startup led by members of the Trump family. The firm has introduced various digital assets, including a stablecoin named USD1 and a memecoin dubbed TRUMP. These ventures have reportedly generated substantial revenue, with estimates suggesting that the Trump family holds a significant stake in WLFI’s profits.

Lawmakers Demand Transparency

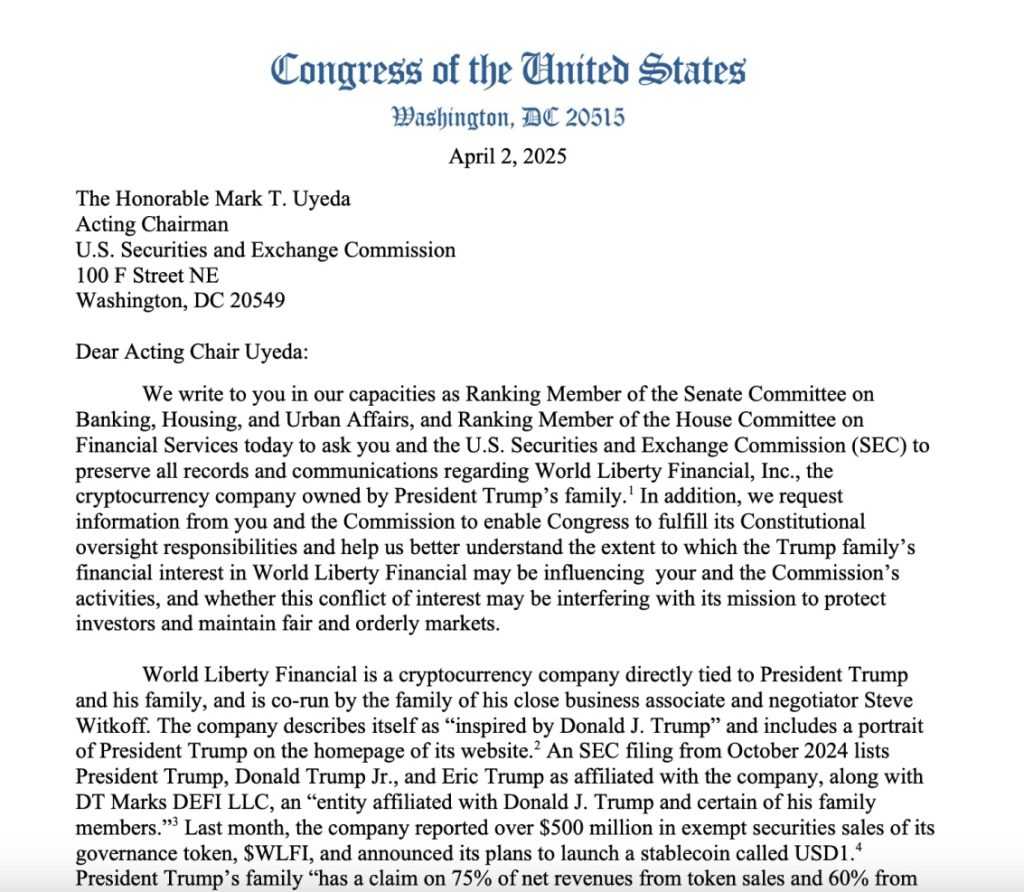

On April 2, Representative Maxine Waters and Senator Elizabeth Warren sent a joint letter to the Securities and Exchange Commission (SEC), urging the agency to investigate WLFI’s operations. The lawmakers expressed concerns about potential conflicts of interest, given the Trump family’s deep financial ties to the firm. They highlighted that WLFI had raised over $500 million through token sales and that the Trump family was entitled to a substantial portion of the profits.

Lawmakers’ Letter to the SEC

Potential Implications for the Crypto Industry

The scrutiny surrounding WLFI has broader implications for the cryptocurrency industry. Lawmakers fear that the Trump family’s involvement could influence regulatory decisions, potentially compromising the integrity of financial oversight. Furthermore, the situation underscores the need for clear guidelines to prevent conflicts of interest and ensure transparency in the rapidly evolving crypto space.

Conclusion

As the debate over WLFI continues, it serves as a reminder of the challenges facing the cryptocurrency industry. While innovation and growth are essential, they must be balanced with accountability and transparency. The actions of high-profile individuals, such as President Trump, highlight the importance of establishing robust regulatory frameworks to safeguard the interests of investors and maintain public trust.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making investment decisions.

Mihajlo Tošić is a content writer specializing in iGaming, crypto, and Web3. He focuses on clear, direct writing that helps brands explain, sell, or promote what they do — without overcomplicating things.