Quick Summary

- Former President Donald Trump slams the Federal Reserve as “slow moving” and urges immediate interest rate cuts.

- Traditional markets tumble as recession fears grow; crypto markets echo the panic but may benefit from looser monetary policy.

- Speculation mounts: Could a Fed rate cut be the spark for the next major Bitcoin and altcoin rally?

- Trump positions himself as a champion of economic revival, calling on the Fed to act swiftly to stabilize markets.

- Analysts divided over whether monetary easing will help equities, but many agree: crypto could surge.

In a familiar tone, former U.S. President Donald Trump reignited his criticism of the Federal Reserve, calling it “slow-moving” and urging the central bank to slash interest rates as traditional financial markets continued their downward spiral. Trump’s remarks came via a Truth Social post early Monday, as global equity indices and U.S. futures faced yet another red day.

“The Fed needs to cut rates NOW,” Trump declared. “Their slowness is costing us dearly. Inflation is down, markets are crashing, and yet they sit on their hands.”

Crypto at a Crossroads

While Trump’s frustration with the Fed is nothing new, his comments hit differently in today’s economic environment. Crypto markets, once considered isolated from macro narratives, have become increasingly sensitive to interest rate shifts. Bitcoin (BTC), Ethereum (ETH), and other major altcoins initially slid alongside equities, but many traders now speculate that a rate cut could flip the script.

“This could be the bullish pivot we’ve been waiting for,” tweeted @CryptoMacroWatch, a well-followed market analyst. “Rate cuts = liquidity = rocket fuel for crypto.

History Rhymes: Trump, the Fed, and Market Stimulus

This isn’t the first time Trump has pressured the Fed. During his presidency, he frequently lobbied for lower interest rates and more accommodative policies, especially in the lead-up to the 2020 election. Back then, those calls were met with mixed reactions—but also coincided with a notable bull run in both stocks and crypto.

Market watchers note that a similar dynamic could emerge now. While the Fed has held firm on its tightening policies to tame inflation, cooling CPI data and rising unemployment could force its hand.

“The market has been bracing for a policy shift, and even a subtle signal from the Fed could send digital assets soaring,” said Edward Moya, Senior Market Analyst at OANDA.

Source: Trading View

Will Crypto Lead the Rebound?

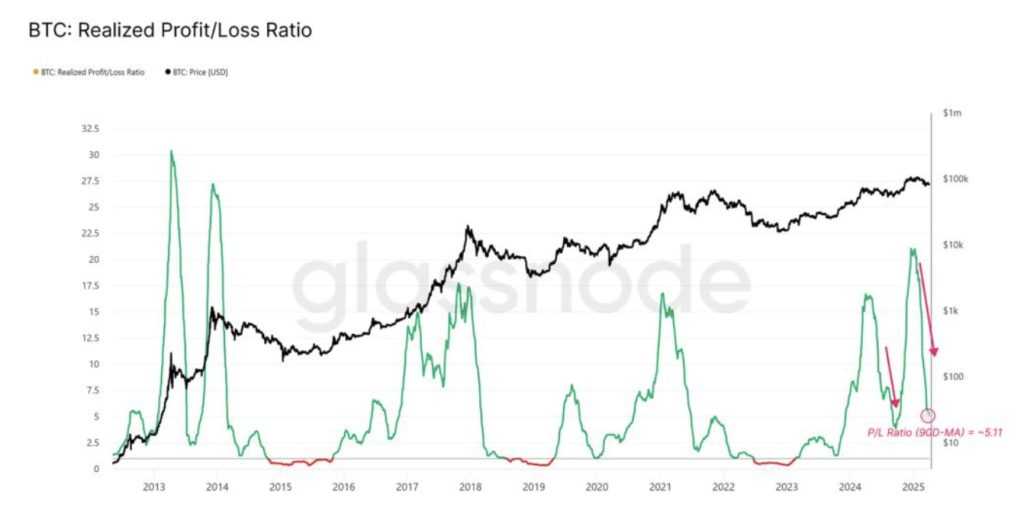

Recent on-chain data shows increased stablecoin inflows into exchanges—a traditional precursor to heightened buying activity. At the same time, crypto derivatives markets are flashing signs of renewed bullish positioning.

Couple that with Trump’s aggressive rhetoric, and the stage could be set for a policy shift that crypto bulls have long awaited.

*”Crypto doesn’t need an invitation—just a signal,” said analyst Marcus D. of ChainLens Research. “If Powell flinches, Bitcoin could fly.”

Trump and 2025: A Political Catalyst for Markets?

Trump’s call for Fed intervention may also serve his broader campaign narrative. By emphasizing economic instability and blaming current leadership, he sets himself up as the solution for what ails both Wall Street and Main Street.

Whether or not the Fed yields, Trump’s remarks are already shaping market expectations. For crypto holders and traders, his pressure campaign might just usher in the next breakout moment.

Bottom Line: Trump wants the Fed to slash rates, markets are buckling under pressure, and crypto—sitting at the intersection of monetary policy and speculation—might be the biggest winner if rate cuts come sooner than expected.

Disclaimer: This article is for informational purposes only. It is not financial advice. Always do your own research (DYOR) before investing in cryptocurrencies.

Filip is a copywriter for startups and B2B SaaS. He’s also been working as a marketer for a variety of crypto projects since 2020.